For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.1796, amid continuous political uncertainty in Italy.

On the economic front, the Euro-zone’s seasonally adjusted construction output declined 0.3% on a monthly basis in March, dipping for the third straight month and after recording a revised fall of 0.7% in the previous month.

Macroeconomic data showed that the number of Americans filing for fresh unemployment benefits climbed more-than-anticipated to a level of 222.0K in the week ended 12 May, hitting a 1-month high level and compared to market expectations for an advance to a level of 215.0K. Initial jobless claims had registered a level of 211.0K in the prior week. Moreover, the nation’s Philadelphia Fed manufacturing index unexpectedly surged to a 12-month high level of 34.4 in May, defying market consensus for a fall to a level of 21.0, thus suggesting that manufacturing activity is gaining momentum in the world’s largest economy. The index had registered a reading of 23.2 in the prior month. Additionally, the nation’s leading index climbed 0.4% on a monthly basis in April, at par with market expectations. The index had registered a revised similar rise in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1802, with the EUR trading 0.05% higher against the USD from yesterday’s close.

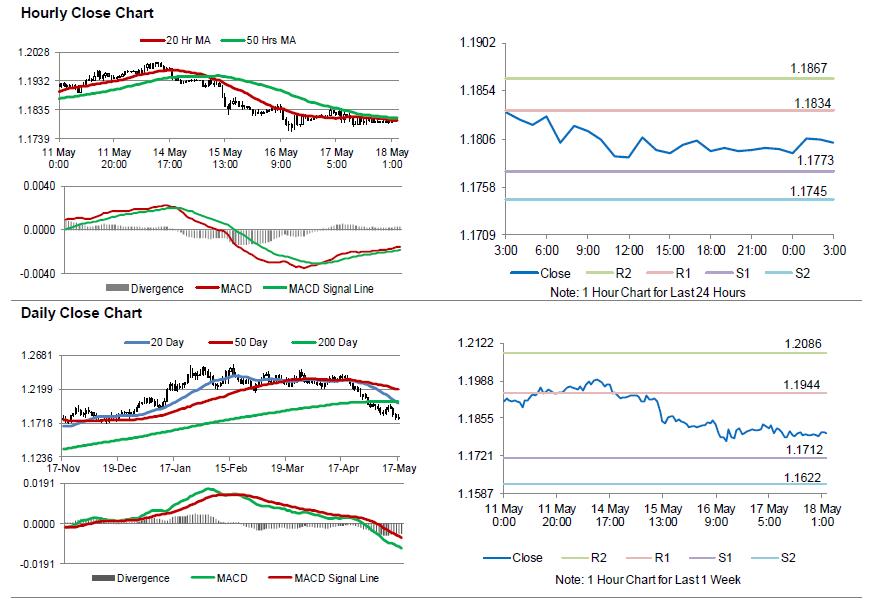

The pair is expected to find support at 1.1773, and a fall through could take it to the next support level of 1.1745. The pair is expected to find its first resistance at 1.1834, and a rise through could take it to the next resistance level of 1.1867.

Going ahead, market participants would focus on the Euro-zone’s trade balance figures for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.