For the 24 hours to 23:00 GMT, the EUR declined 0.6% against the USD and closed at 1.0604 on Friday, after data revealed that the Euro-zone’s seasonally adjusted construction output dropped 0.2% MoM in December, declining for the first time in three-months. In the prior month, construction output had registered a revised gain of 0.9%. Also, the region’s seasonally adjusted current account surplus narrowed to a level of €31.0 billion in December, less than market consensus for a fall to a level of €28.7 billion and after recording a revised surplus of €36.4 billion in the previous month.

The US Dollar gained ground against most of its key counterparts, after the US leading indicator rose 0.6% in January, notching its highest level since April 2016 and surpassing market expectations for a rise of 0.5%. In the previous month, leading indicator had advanced 0.5%.

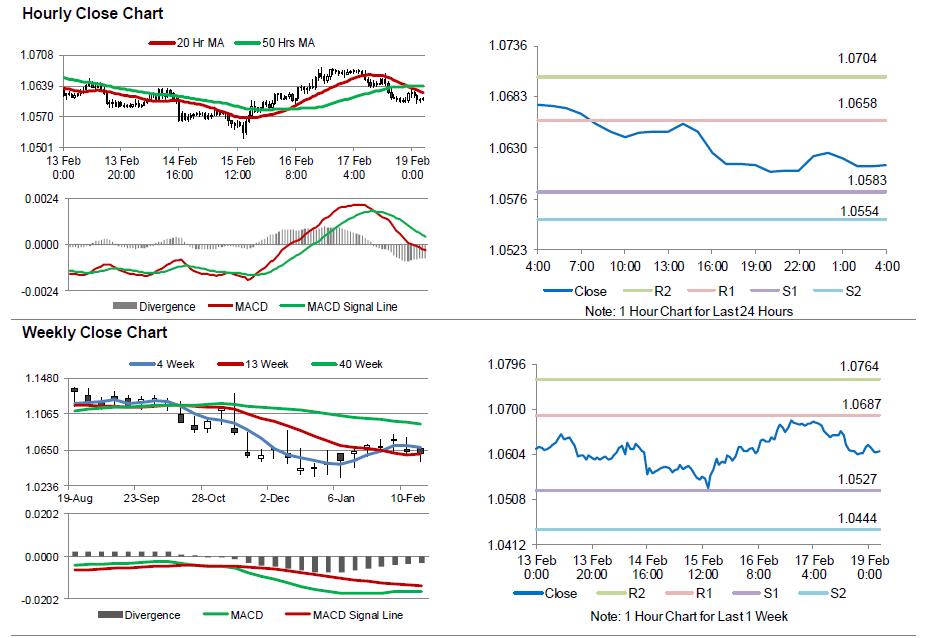

In the Asian session, at GMT0400, the pair is trading at 1.0611, with the EUR trading 0.07% higher against the USD from Friday’s close.

The pair is expected to find support at 1.0583, and a fall through could take it to the next support level of 1.0554. The pair is expected to find its first resistance at 1.0658, and a rise through could take it to the next resistance level of 1.0704.

Going ahead, investors will focus on the Euro-zone’s preliminary consumer confidence index for February along with German Buba monthly report, scheduled to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.