For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.1375.

Macroeconomic data showed that that the Euro-zone’s final consumer confidence index climbed for a second consecutive month to a level of -7.4 in February, in line with market consensus and confirming the preliminary print. In the previous month, the index had recorded a reading of -7.90.

On the other hand, the region’s economic sentiment indicator declined for the eighth consecutive month to a level of 106.1 in February and less than market expectations for a fall to a level of 106.0. In the previous month, the indicator had recorded a revised level of 106.3. Meanwhile, the business climate indicator remained steady at 0.69, defying market consensus for a fall to a level of 0.66.

The US dollar strengthened against the euro, as cautious comments from the US Trade Representative, Robert Lighthizer, sparked worries over progress in US-China trade talks.

In the US, data indicated that the US advance goods trade deficit widened to $79.5 billion in December, following a deficit of $70.5 billion in the previous month. Market participants had envisaged the nation to post a deficit of $73.6 billion. Further, the nation’s pending home sales declined 3.2% on an annual basis in January, compared to a fall of 9.5% in the preceding month. Markets had envisaged pending home sales to drop 4.6%.

On the contrary, the US factory orders rebounded 0.1% on a monthly basis in December, undershooting market expectations for a rise of 0.6%. In the previous month, factory orders had recorded a revised decline of 0.5%. Additionally, the final durable goods orders advanced 1.2% on a monthly basis in December, confirming the preliminary print and following a revised gain of 1.0% in the previous month. Further, the nation’s MBA mortgage applications climbed 5.3% on a weekly basis in the week ended 22 February 2019, compared to a rise of 3.6% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.1378, with the EUR trading slightly higher against the USD from yesterday’s close.

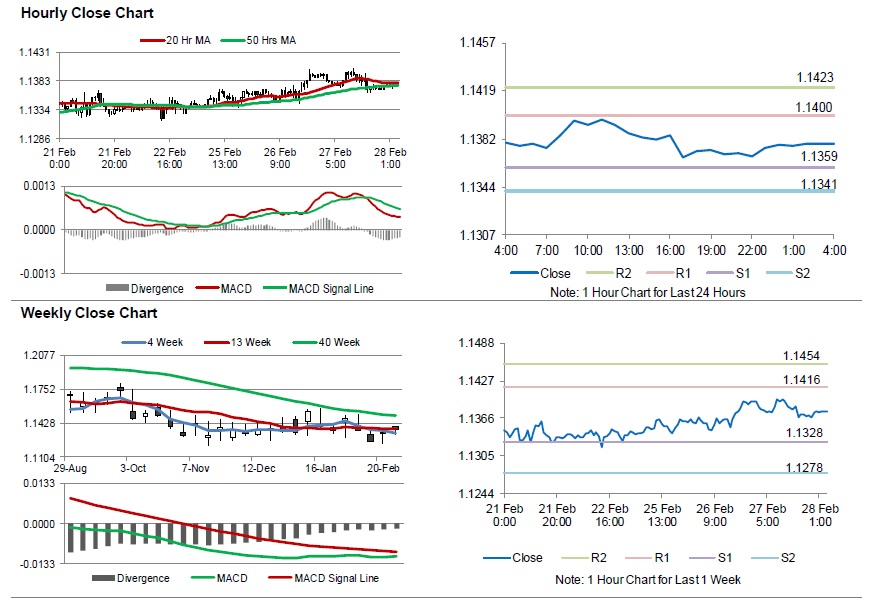

The pair is expected to find support at 1.1359, and a fall through could take it to the next support level of 1.1341. The pair is expected to find its first resistance at 1.1400, and a rise through could take it to the next resistance level of 1.1423.

Looking ahead, traders would await Germany’s consumer price index for February, set to release in a few hours. Later in the day, the US annualised gross domestic product for 4Q and the Chicago Purchasing Managers’ Index for February along with initial jobless claims, will pique significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.