For the 24 hours to 23:00 GMT, the EUR rose 0.05% against the USD and closed at 1.1345.

On the data front, the Euro-zone’s flash consumer confidence index advanced to a level of -7.4 in February, more than market consensus for a gain to a level of -7.7. The index had registered a reading of -7.9 in the previous month.

Separately, in Germany, the producer price inflation (PPI) slowed to an eight-month low level of 2.6% on an annual basis in January, compared to a level of 2.7% in the previous month.

In the US, data showed that the US mortgage applications rebounded 3.6% on a weekly basis in the week ended 15 February 2019, rising for the first time in five weeks and following a revised drop of 6.9% in the previous week.

The FOMC meeting minutes revealed why the Federal Reserve (Fed) decided to remain patient with monetary policy and how they would deal with its balance sheet. The minutes also showed extensive discussion of market conditions. Further, the officials expressed uncertainty over whether they would raise interest rates again in 2019. Meanwhile, members stated that holding the federal funds rate in a target range of 2.25% to 2.5% would pose few risks at this point.

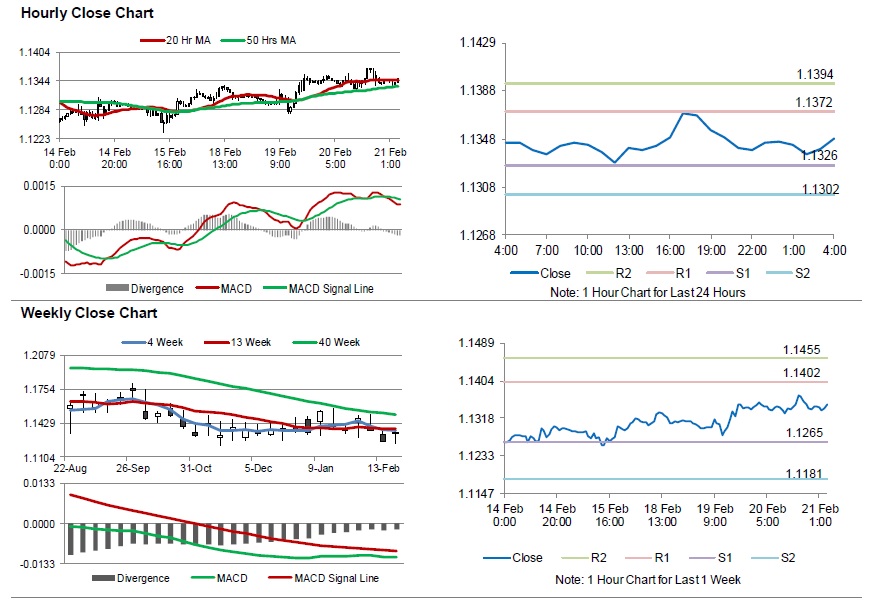

In the Asian session, at GMT0400, the pair is trading at 1.1349, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1326, and a fall through could take it to the next support level of 1.1302. The pair is expected to find its first resistance at 1.1372, and a rise through could take it to the next resistance level of 1.1394.

Moving ahead, traders would closely monitor the Markit manufacturing and services PMI’s, set to release across the euro bloc in a few hours. Additionally, Germany’s consumer price index for February, will pique significant amount of investors’ attention. Later in the day, the US Markit services and manufacturing PMI’s and the Philadelphia Fed business outlook, both for February, along with durable goods orders for December and existing home sales for January will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.