For the 24 hours to 23:00 GMT, the EUR rose 0.86% against the USD and closed at 1.1202 on Friday.

On the macro front, the Euro-zone’s consumer confidence index rose less than expected to a level of -3.3 in May, reaching its best level in a decade as the region shrugged off populist political risks in 2017. Markets expected for an advance to a level of -3.0, after recording a level of -3.6 in the prior month. Additionally, the Eurozone’s seasonally adjusted current account surplus eased to €34.1 billion in March from a revised figure of €37.8 billion recorded in the last month.

Elsewhere, Germany’s producer prices climbed 3.4% YoY in April to their highest level in nearly six years, surpassing market expectations for a gain of 3.2% and following a rise of 3.1% in the previous month.

The greenback fell against its major peers on Friday, as political uncertainty continued to weigh on the currency and depressed investor sentiment.

In the US, St. Louis Federal Reserve (Fed) President James Bullard stated that central bank’s proposed interest rate hikes might be too aggressive, citing that the nation’s economy had slowed since March and inflation had also dipped, thus making the case for a continued go-slow approach.

In the Asian session, at GMT0300, the pair is trading at 1.1190, with the EUR trading 0.11% lower against the USD from Friday’s close.

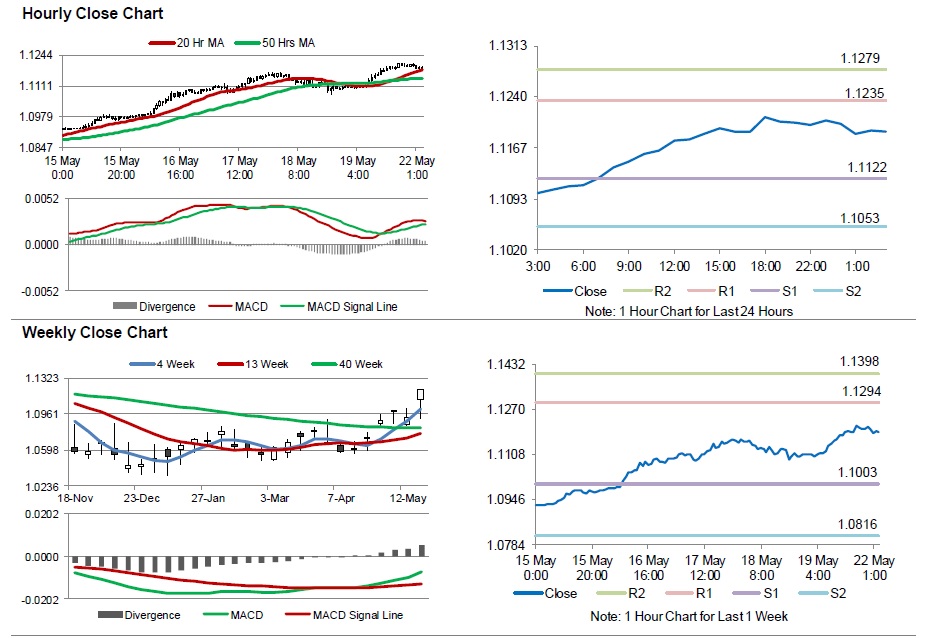

The pair is expected to find support at 1.1122, and a fall through could take it to the next support level of 1.1053. The pair is expected to find its first resistance at 1.1235, and a rise through could take it to the next resistance level of 1.1279.

With no economic data in the Euro-zone today, traders will look forward to the US Chicago Fed National Activity index for April, scheduled later in the day, for further direction in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.