For the 24 hours to 23:00 GMT, the EUR declined 0.10% against the USD and closed at 1.1082.

On the macro front, Euro-zone’s consumer price inflation slowed to 1.0% on a yearly basis in July, marking its lowest level since November 2016 and compared to a level of 1.3% in the previous month. The preliminary figures had recorded a reading of 1.1%. Additionally, the region’s seasonally adjusted current account surplus narrowed to €18.4bn in June, hitting its lowest level since January 2017 and following a revised surplus of EUR30.3bn in the previous month.

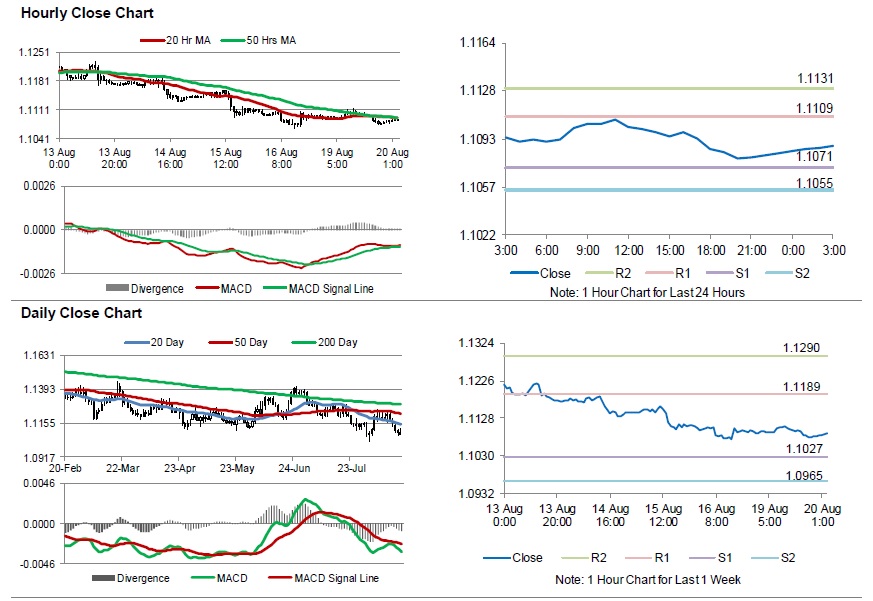

In the Asian session, at GMT0300, the pair is trading at 1.1088, with the EUR trading 0.05% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1071, and a fall through could take it to the next support level of 1.1055. The pair is expected to find its first resistance at 1.1109, and a rise through could take it to the next resistance level of 1.1131.

Amid no major economic news in the US, traders would await Euro-zone’s construction output for June and Germany’s producer price index for July, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.