For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.0669 on Friday, after the release of disappointing inflation data from the Euro-zone.

The preliminary consumer price index (CPI) advanced less-than-anticipated by 1.5% on an annual basis in March, offering some respite to the European Central Bank as it faces pressure to wind down its massive monetary stimulus programme. Markets expected the region’s CPI to rise 1.8%, following a gain of 2.0% in the prior month.

Separately, Germany’s seasonally adjusted unemployment rate unexpectedly dropped to a new record low level of 5.8% in March, while investors had envisaged the unemployment rate to remain steady at 5.9%. Further, the nation’s retail sales rebounded 1.8% MoM in February, surpassing market expectations for an increase of 0.7% and posting its strongest increase since August 2014. In the prior month, retail sales had dropped by a revised 1.0%.

In the US, macroeconomic data indicated that personal spending edged up 0.1% in February, undershooting market expectations for a rise of 0.2%. In the prior month, personal spending had recorded a rise of 0.2%. The nation’s personal income recorded a rise of 0.4% in February, at par with market expectations and after registering a revised rise of 0.5% in the previous month. Meanwhile, the nation’s final Reuters/Michigan consumer sentiment index was revised down to a level of 96.9 in March, compared to a level of 97.6, registered in the flash estimate. The index had recorded a reading of 96.3 in the previous month.

Separately, several Federal Reserve (Fed) officials indicated that they expect interest rate increases this year, but each portrayed a cautious tone about the US economy.

In the Asian session, at GMT0300, the pair is trading at 1.0678, with the EUR trading 0.08% higher against the USD from Friday’s close.

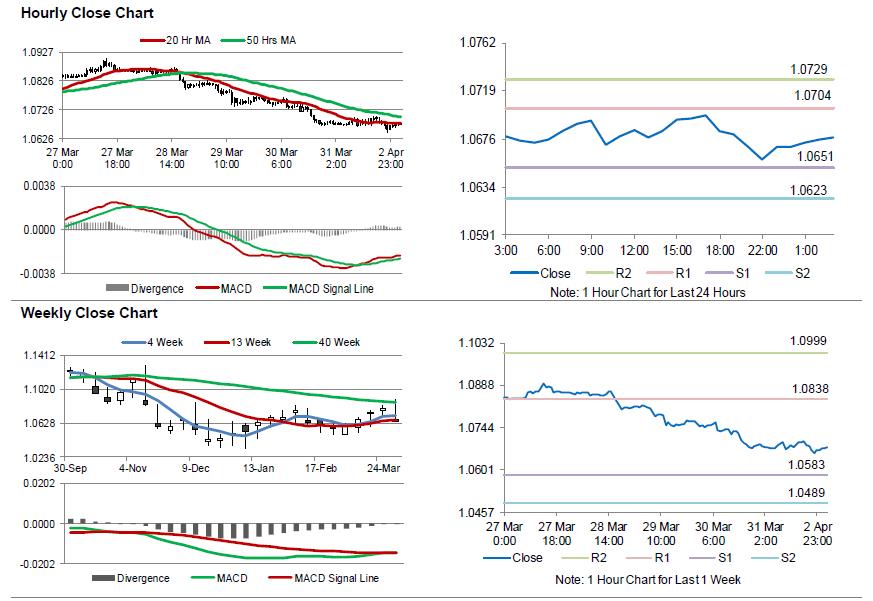

The pair is expected to find support at 1.0651, and a fall through could take it to the next support level of 1.0623. The pair is expected to find its first resistance at 1.0704, and a rise through could take it to the next resistance level of 1.0729.

Going ahead, investors will look forward to the Euro-zone’s unemployment rate for February and the final reading of the Markit manufacturing PMI across the Eurozone for March, all slated to release in a few hours. Additionally, the US ISM as well as the final Markit manufacturing PMI’s for March and construction spending data for February, scheduled to release later in the day, will be on investors radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.