For the 24 hours to 23:00 GMT, the EUR declined 0.28% against the USD and closed at 1.1956, after the latest data revealed that Euro-bloc’s economic growth slowed at the start of the new year.

The Euro-zone’s seasonally adjusted preliminary gross domestic product (GDP) advanced 0.4% on a quarterly basis in the first quarter of 2018, meeting market expectations. In the previous quarter, GDP had risen 0.7%. Additionally, the region’s unemployment rate remained steady at 8.5% in March, in line with market anticipations.

In other economic news, the Euro-zone’s final Markit manufacturing PMI fell less than initially estimated to a level of 56.2 in April, while the preliminary figures had indicated a fall to a level of 56.0. The PMI had registered a reading of 56.6 in the prior month.

Separately, Germany’s final Markit manufacturing PMI eased to a level of 58.1 in April, confirming the flash reading and following a level of 58.2 in the previous month.

The US Dollar advanced against a basket of major currencies, after the US Federal Reserve (Fed), expressed growing confidence that inflation is inching closer to its goal.

The Fed, at its May monetary policy meeting, unanimously decided to keep the benchmark interest rate unchanged at a target range of 1.50% to 1.75%, meeting market expectations. Further, the central bank expressed more confidence in its inflation outlook, stating that annual inflation is expected to run near the central bank’s 2.0% target over the medium term.

On the macro front, ADP private sector employment in the US climbed more-than-anticipated by 204.0K in April, compared to market anticipations for a rise of 198.0K. However, it was the smallest increase since November 2017. The private sector employment had registered a revised gain of 228.0K in the prior month. Meanwhile, the nation’s MBA mortgage applications declined 2.5% in the week ended 27 April, compared to a drop of 0.2% in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1978, with the EUR trading 0.18% higher against the USD from yesterday’s close.

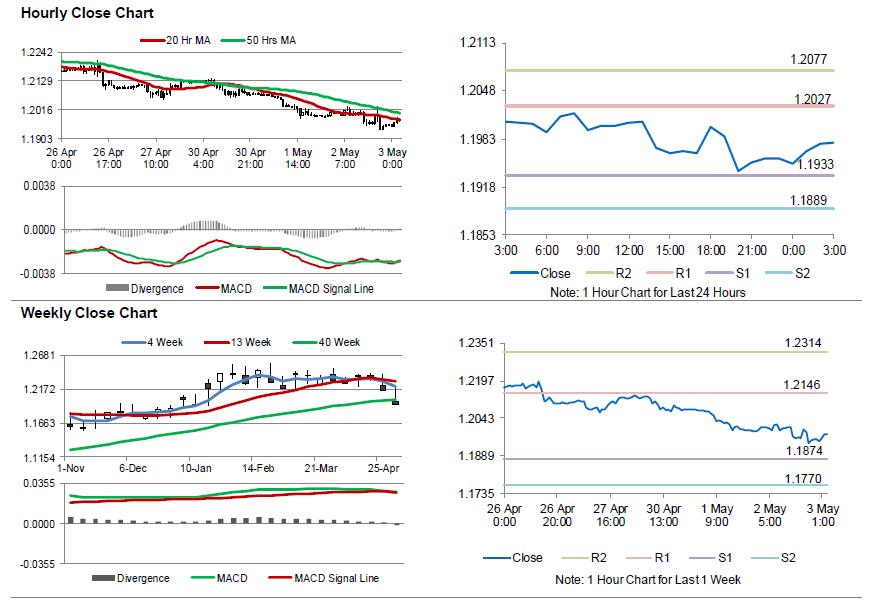

The pair is expected to find support at 1.1933, and a fall through could take it to the next support level of 1.1889. The pair is expected to find its first resistance at 1.2027, and a rise through could take it to the next resistance level of 1.2077.

Looking forward, traders would focus on the Euro-zone’s flash inflation figures for April, scheduled to release in a few hours. Additionally, the US initial jobless claims and the ISM manufacturing PMI for April along with trade balance, final durable goods orders and factory orders data, all for March, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.