For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.0839 on Friday.

Data showed that Euro-zone’s gross domestic product (GDP) grew 0.1% on a quarterly basis in 4Q19, registering its slowest expansion since early 2013 and compared to a revised increase of 0.3% in the previous quarter. Meanwhile, trade surplus widened to €22.2 billion in December, surpassing market forecast for a surplus of €21.6 billion and compared to a revised surplus of €19.1 billion in the previous month. Separately, in Germany, economic growth recorded a flat reading in 4Q19, compared to a revised rise of 0.2% in the prior quarter.

In the US, advance retail sales rose 0.3% on a monthly basis in January, in line with market forecast and compared to a revised rise of 0.2% in the previous month. Moreover, the Michigan consumer sentiment index unexpectedly advanced to a level of 100.9 in February, notching its highest level since 2018. In the previous month, the index had recorded a level of 99.8. Further, business inventories advanced 0.1% in December, in line with market expectations and compared to a drop of 0.2% in the earlier month. Meanwhile, industrial production dropped 0.3% on a monthly basis in January, led by a steep drop in utilities output and compared to a revised fall of 0.4% in the prior month. Additionally, manufacturing production fell 0.1% on a monthly basis in January, as Boeing significantly lowered its production of civilian aircraft amid the grounding of its 737 Max. In the previous month, manufacturing production had recorded a revised rise of 0.1%.

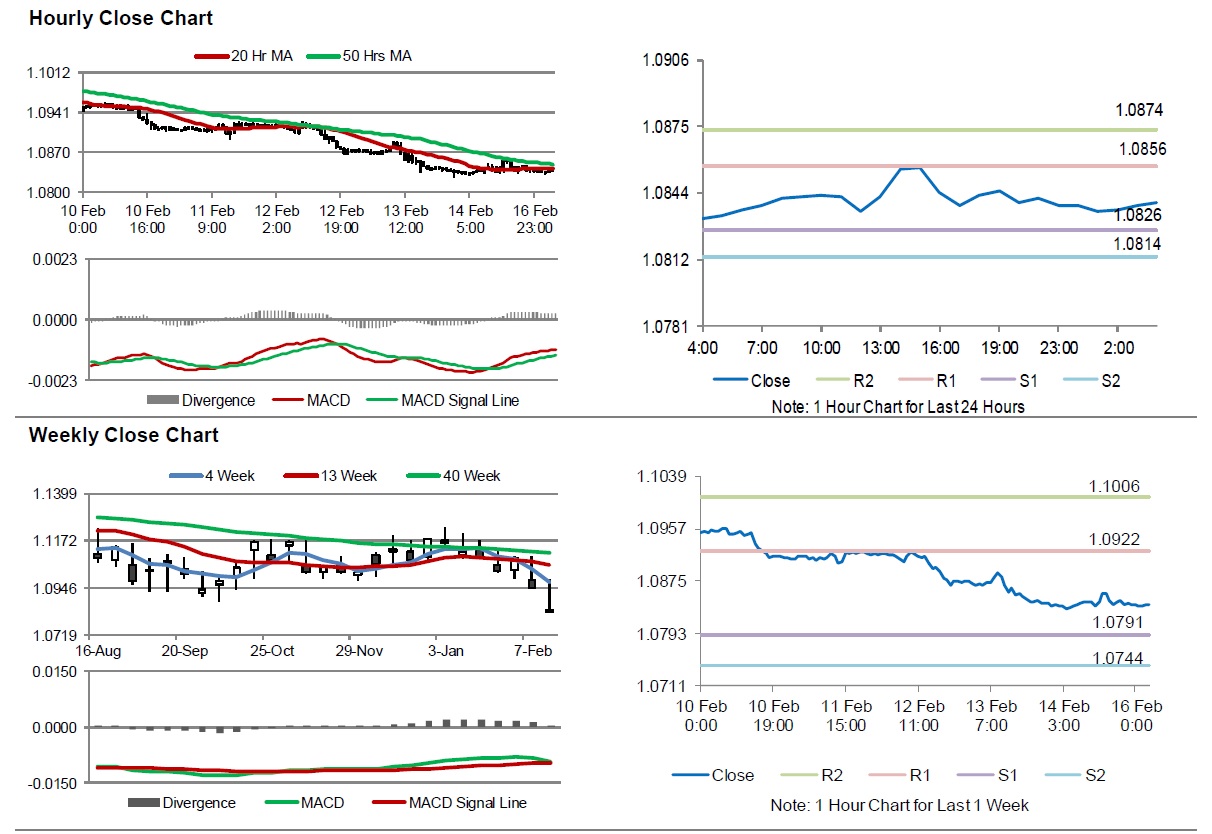

In the Asian session, at GMT0400, the pair is trading at 1.0839, with the EUR trading flat against the USD from Friday’s close.

The pair is expected to find support at 1.0826, and a fall through could take it to the next support level of 1.0814. The pair is expected to find its first resistance at 1.0856, and a rise through could take it to the next resistance level of 1.0874.

In absence of key macroeconomic releases in the US today, investors would direct their attention to Euro-zone’s construction output for December, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.