For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1368

In economic news, the Euro-zone’s final consumer confidence index declined to a level of -7.2 in June, meeting market expectations and confirming the preliminary print. The index had recorded a level of -6.5 in the prior month. Moreover, the region’s economic sentiment indicator dropped to its lowest level in 3 years to 103.3 in June, compared to a revised level of 105.2 in the previous month. Market participants had envisaged the indicator to record a fall to a level of 104.9. Also, the business climate indicator eased to 0.17 in June, more than market forecast and compared to a reading of 0.30 in the prior month.

Separately, in Germany, the preliminary consumer price index (CPI) advanced 1.6% on an annual basis in June. In the prior month, the CPI had registered a rise of 1.4%.

In the US, data showed that final annualised gross domestic product rose 3.1% on a quarterly basis in the 1Q 2019, confirming the preliminary print and undershooting market anticipations for a gain of 3.2%. The annualised GDP had climbed 2.2% in the prior quarter. Meanwhile, the nation’s pending home sales unexpectedly fell 0.8% on an annual basis in May, compared to a rise of 0.4% in the prior month. Market participants had envisaged pending home sales to record a rise of 0.4%. Additionally, seasonally adjusted initial jobless claims advanced to a level of 227.0K in the week ended 22 June 2019, compared to a revised level of 217.0 K in the prior week. Markets had expected initial jobless claims to climb to a level of 220.0K.

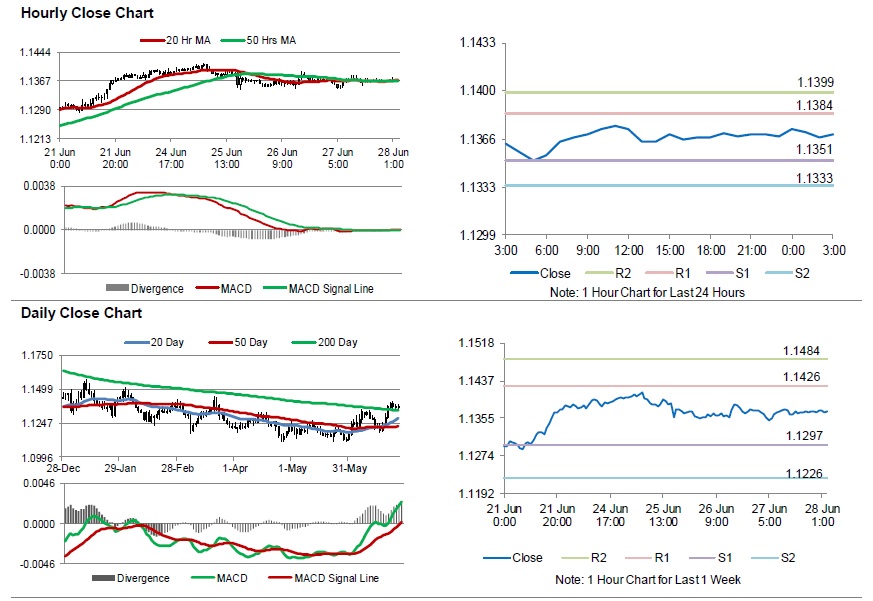

In the Asian session, at GMT0300, the pair is trading at 1.1369, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1351, and a fall through could take it to the next support level of 1.1333. The pair is expected to find its first resistance at 1.1384, and a rise through could take it to the next resistance level of 1.1399.

Looking ahead, traders would await Euro-zone’s consumer price index for June, slated to release in a few hours. Later in the day, the US personal income and personal spending data, both for May along with the Chicago Purchasing Managers’ Index and the Michigan consumer sentiment index, both for June, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.