For the 24 hours to 23:00 GMT, the EUR declined 0.17% against the USD and closed at 1.1808, shrugging off robust GDP report from the Euro-zone.

Data showed that the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) advanced 0.6% on a quarterly basis in the second quarter of 2017, meeting market expectations, thus painting a bright picture of the region’s economy that could allow the European Central Bank (ECB) to scale back its monetary stimulus programme before the end of the year. In the previous quarter, the region’s GDP had registered a revised rise of 0.5%.

On the other hand, the region’s final Markit manufacturing PMI was revised lower to a level of 56.6 in July, compared to a preliminary print indicating a fall to a level of 56.8. In the previous month, the PMI had registered a reading of 57.4.

Separately, Germany’s manufacturing sector growth slowed more than initially estimated, after the final Markit manufacturing PMI fell to a level of 58.1 in July, compared to a drop to a level of 58.3 recorded in the flash estimate. In the prior month, the PMI had registered a reading of 59.6.

Meanwhile, the nation’s seasonally adjusted unemployment rate remained steady at 5.7% in July, meeting market expectations.

Macroeconomic data revealed that the US ISM manufacturing activity index dropped more-than-expected to a level of 56.3 in July, amid a slowdown in new orders. The index had recorded a reading of 57.8 in the prior month, while investors had envisaged for a decline to a level of 56.4. Also, the nation’s construction spending unexpectedly eased 1.3% on a monthly basis in June, as spending on government projects plummeted by the most in 15 years. Construction spending had registered a revised advance of 0.3% in the prior month, compared to market consensus for an increase of 0.4%.

On the other hand, the nation’s personal spending rose 0.1% in June, at par with market expectations. In the prior month, personal spending had risen by a revised 0.2%. Meanwhile, the nation’s personal income surprisingly remained flat in June, compared to market expectations for a gain of 0.4%. In the prior month, personal income had risen by a revised 0.3%. Further, the nation’s final Markit manufacturing PMI was revised higher to a level of 53.3 in July, compared to an advance to a level of 53.2 reported in the flash estimate. The PMI had recorded a reading of 52.0 in the prior month.

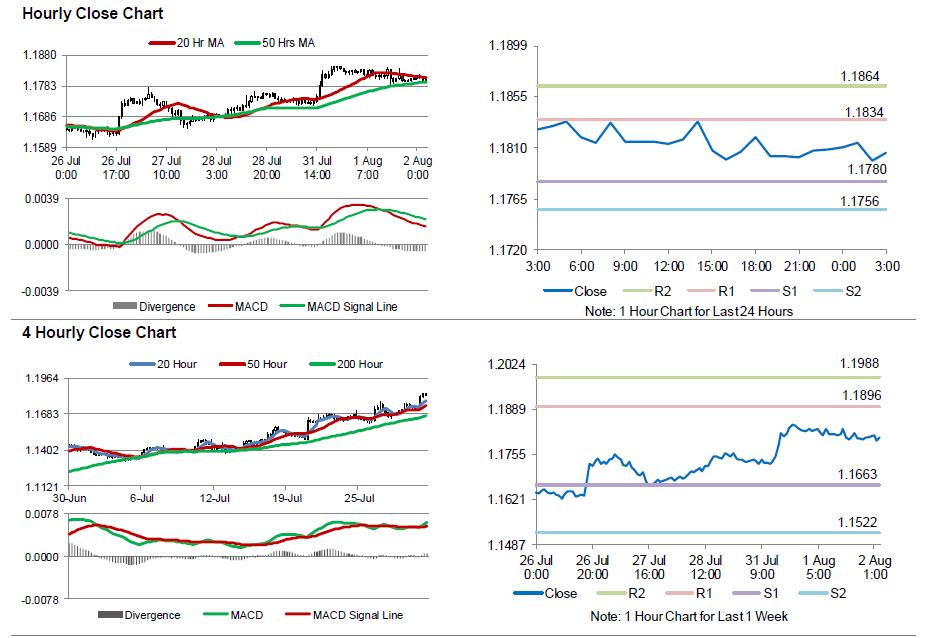

In the Asian session, at GMT0300, the pair is trading at 1.1805, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1780, and a fall through could take it to the next support level of 1.1756. The pair is expected to find its first resistance at 1.1834, and a rise through could take it to the next resistance level of 1.1864.

Going ahead, investors will look forward to the Euro-zone’s producer price index for June, slated to release in a few hours. Additionally, the US ADP jobs report for July, scheduled to release later in the day, will pique significant amount of investor attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.