For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.1778, after the second estimate of the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) advanced 0.6% on a quarterly basis in the second quarter of 2017, confirming the preliminary print, thus suggesting that the economy retained its momentum in the second quarter. In the previous quarter, the region’s GDP had registered a revised rise of 0.5%.

The US Dollar lost ground against its major counterparts, after minutes of the Federal Reserve’s (Fed) latest monetary policy meeting showed that policymakers were divided on raising interest rate again this year.

According to minutes, some officials remained increasingly wary over recent softness in inflation and called for halting interest rate hikes until it was clear that the recent softness in inflation is transitory, while some argued that such a delay could cause an eventual overshooting in inflation, provided a tightening labour market. Further, it also indicated that the central bank was poised to begin paring back its $4.5 trillion balance sheet as soon as September.

The US Dollar extended losses, aided by fresh political uncertainty in the US after the dissolution of a pair of business advisory groups by the US President, Donald Trump, after several CEOs stepped down from his advisory panels to protest his comments about violence in Charlottesville, Virginia.

On the data front, housing starts in the US unexpectedly dropped 4.8% on monthly basis, to an annual rate of 1155.0K in July, defying market expectations for an advance to a level of 1220.0K. Housing starts had recorded a revised level of 1213.0K in the prior month. Moreover, the nation’s building permits eased more-than-anticipated by 4.1% on a monthly basis, to an annual rate of 1223.0K in July, compared to market consensus for it to drop to a level of 1250.0K. Building permits had registered a revised level of 1275.0K in the prior month.

On the other hand, the nation’s mortgage applications climbed 0.1% in the week ended 11 August 2017, after recording a rise of 3.0% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1783, with the EUR trading marginally higher against the USD from yesterday’s close.

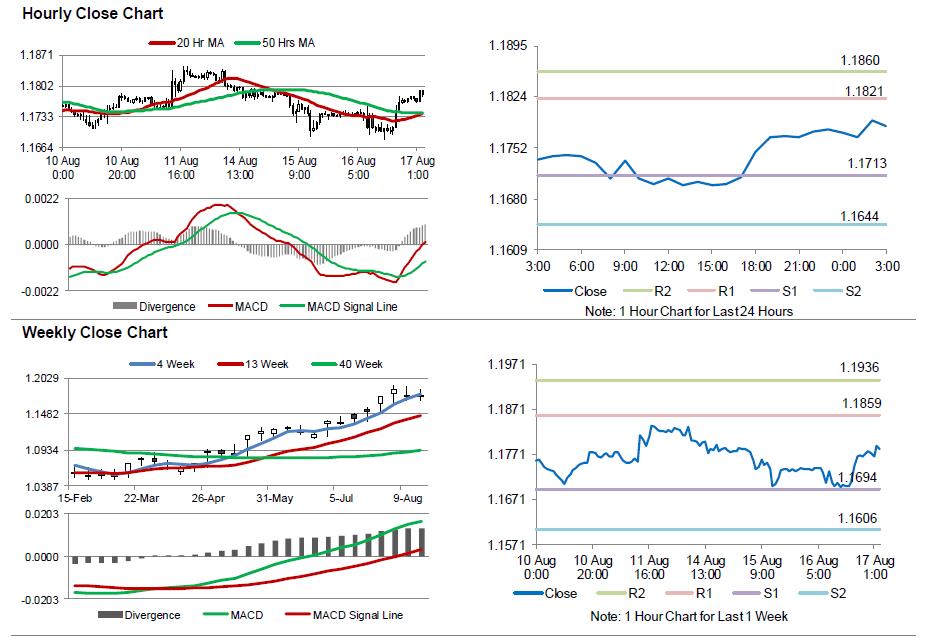

The pair is expected to find support at 1.1713, and a fall through could take it to the next support level of 1.1644. The pair is expected to find its first resistance at 1.1821, and a rise through could take it to the next resistance level of 1.1860.

Investors will now pay attention to the European Central Bank’s latest meeting minutes, along with the region’s final consumer price index for July and trade balance for June, all slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.