For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.1344, as Euro-zone’s third quarter GDP growth slowed and economic confidence deteriorated, triggering fears over the region’s economic growth prospects.

In the economic news, the Euro-zone’s seasonally adjusted preliminary gross domestic product (GDP) expanded at its weakest pace in 4-years by 0.2% on a quarterly basis in 3Q18, undershooting market consensus for a gain of 0.3%. In the prior quarter, GDP had climbed 0.4%. Moreover, the region’s economic sentiment indicator fell more than expected to 109.8 in October, compared to a level of 110.9 in the previous month. Market participants had expected the economic sentiment indicator to drop to a level of 110.0. Additionally, the business climate indicator eased to a level of 1.01 in October, more than market forecast for a fall to a level of 1.16 and compared to a level of 1.21 in the prior month. Also, the region’s industrial confidence index fell to a level of 3.0 in October, compared to market expectations for a drop to a level of 3.9. The index had recorded a level of 4.7 in the previous month. However, the final consumer confidence index climbed to a level of -2.7 in October, confirming the preliminary print and in line with market anticipations. In the prior month, the index had recorded a reading of -2.9.

Separately, in Germany, the flash consumer price index (CPI) jumped 2.5% on an annual basis in October, notching its highest level in six years and rising at its fastest pace since February 2012. The CPI had increased 2.3% in the preceding month, while market participants had envisaged for a rise of 2.4%. Meanwhile, the nation’s seasonally adjusted unemployment rate remained steady at 5.1% in October, at par with market expectations.

In the US, data showed that the US CB consumer confidence index rose to an 18-year high level of 137.9 in October, driven by strong labour market and compared to a revised level of 135.3 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1340, with the EUR trading a tad lower against the USD from yesterday’s close.

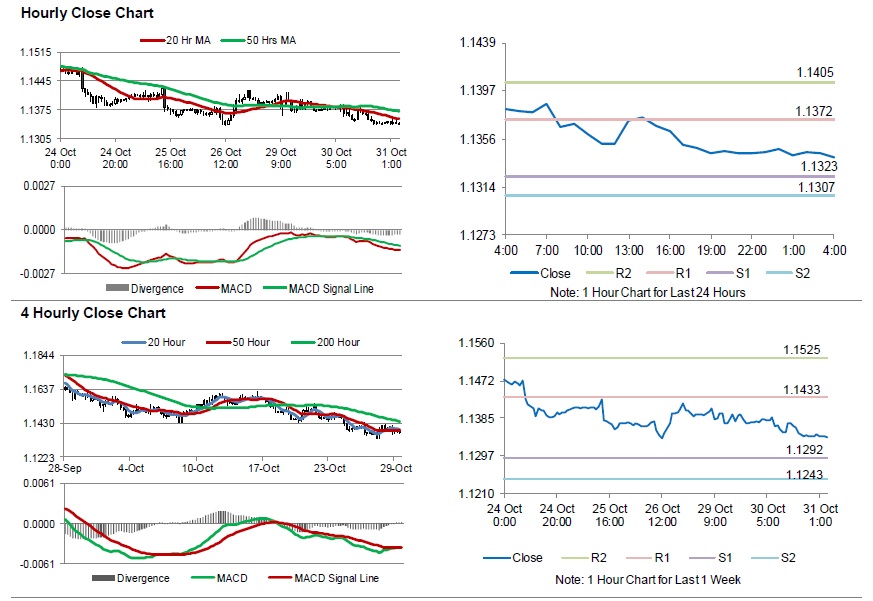

The pair is expected to find support at 1.1323, and a fall through could take it to the next support level of 1.1307. The pair is expected to find its first resistance at 1.1372, and a rise through could take it to the next resistance level of 1.1405.

Going ahead, investors would await the Euro-zone’s unemployment rate for September and consumer price index for October, set to release in a few hours. Moreover, Germany’s retail sales for September due to be released in a few hours, will pique significant amount of investors attention. Later in the day, the US MBA mortgage applications followed by ADP employment change and the Chicago purchasing managers index, both for October, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.