For the 24 hours to 23:00 GMT, the EUR rose 1.04% against the USD and closed at 1.1093, on the back of upbeat economic data from across the Euro-zone.

Data indicated that the Euro-zone’s ZEW economic sentiment index jumped to a level of 35.1 in May, following a reading of 26.3 in the prior month, as concerns over political turmoil across the common currency region receded. Additionally, the region’s second estimate of gross domestic product (GDP) advanced 0.5% on a quarterly basis in the first quarter of 2017, confirming the flash estimate. In the prior quarter, GDP had registered a similar rise. Further, the region’s seasonally adjusted trade surplus widened to a level of €23.1 billion in March, from a revised surplus of €18.8 billion recorded in the prior month, while market participants expected the region to post a surplus of €18.7 billion.

Separately, confidence among German investors strengthened to a nearly two-year high level of 20.6 in May, compared to a reading of 19.5 in the prior month. Investors had envisaged the index to climb to a level of 22.0. Also, the nation’s ZEW current situation index rose more-than-anticipated to a level of 83.9 in May, compared to a level of 80.1 in the previous month.

The greenback lost ground against a basket of major currencies, on reports that the US President, Donald Trump, disclosed highly classified information to Russia’s Foreign Minister about a planned Islamic State operation in a meeting last week.

Earlier in the session, the US Dollar fell against its major peers, after disappointing building permits and housing starts data in the US dampened optimism over the health of the nation’s housing sector.

Housing starts in the US unexpectedly dropped 2.6% on monthly basis, to an annual rate of 1172.0K in April, hitting its lowest level in five months, led by a big drop in construction of apartments. Markets anticipated housing starts to advance to a level of 1260.0K, after recording a revised level of 1203.0K in the previous month. Further, the nation’s building permits surprisingly fell 2.5% on a monthly basis, to an annual rate of 1229.0K in April, compared to market consensus for a rise to a level of 1270.0K and following a level of 1260.0K in the prior month.

On the contrary, the US manufacturing production surged to a more than three-year high level, after it jumped 1.0% in April, surpassing market expectations for an advance of 0.4%. In the previous month, manufacturing production had dropped 0.4%. Moreover, the nation’s industrial production climbed more-than-expected by 1.0% in April, notching its highest level since February 2014. Market participants expected industrial production to gain 0.4%, following a revised rise of 0.4% in the previous month.

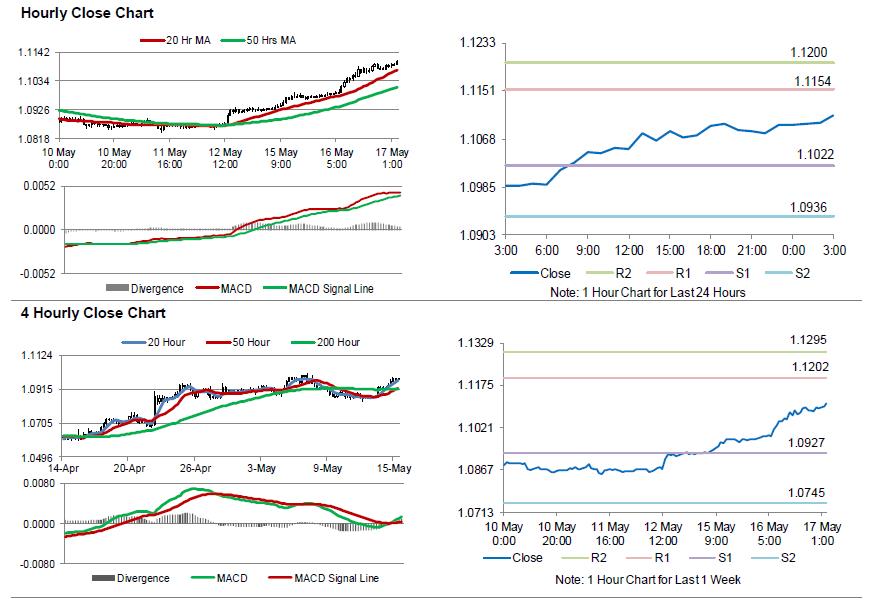

In the Asian session, at GMT0300, the pair is trading at 1.1109, with the EUR trading 0.14% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1022, and a fall through could take it to the next support level of 1.0936. The pair is expected to find its first resistance at 1.1154, and a rise through could take it to the next resistance level of 1.1200.

Moving ahead, all eyes would be on the Euro-zone’s final consumer price index for April, slated to release in a few hours. Moreover, in the US, weekly mortgage applications data will also be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.