For the 24 hours to 23:00 GMT, the EUR declined 0.65% against the USD and closed at 1.1893.

On the data front, the Euro-zone’s seasonally adjusted industrial production rebounded 0.1% MoM in July, meeting market expectations and following a sharp drop of 0.6% in the previous month.

Separately, Germany’s final consumer price index (CPI) registered a rise of 1.8% on an annual basis in August, confirming the preliminary print. The CPI had risen 1.7% in the previous month.

Data released in the US indicated that mortgage applications rose 9.9% in the week ended 08 September, jumping to its strongest level in 10 months and following a gain of 3.3% in the prior week. Further, the nation’s producer prices rose slightly less-than-expected by 0.2% on a monthly basis in August, compared to a drop of 0.1% in the prior month. Meanwhile, the nation’s budget deficit widened less-than-anticipated to a level of $108.0 billion in August, compared to market consensus for a deficit of $119.5 billion. The nation had registered a budget deficit of $42.9 billion in the previous month.

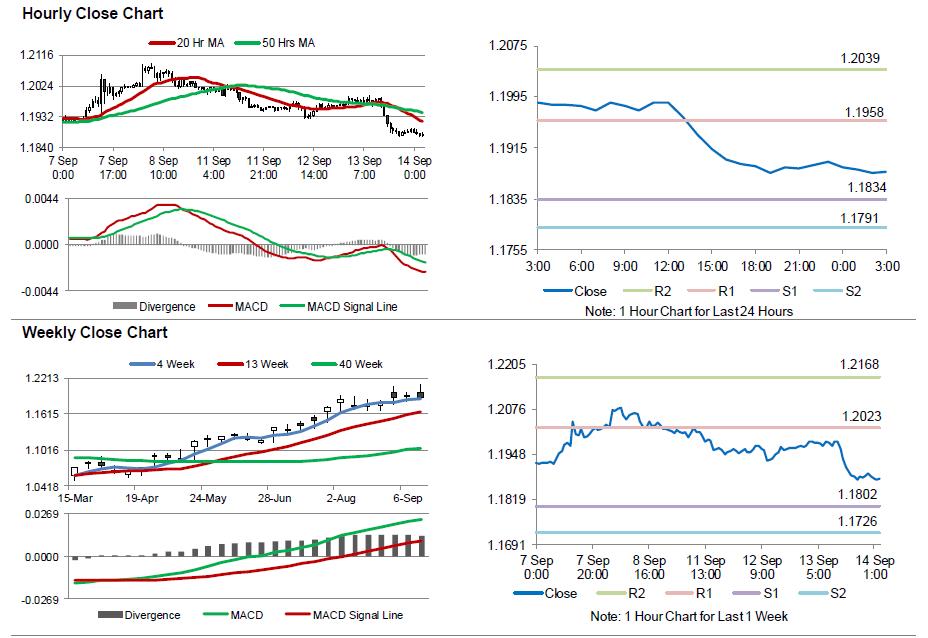

In the Asian session, at GMT0300, the pair is trading at 1.1878, with the EUR trading 0.13% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1834, and a fall through could take it to the next support level of 1.1791. The pair is expected to find its first resistance at 1.1958, and a rise through could take it to the next resistance level of 1.2039.

Amid no major macroeconomic releases in the Euro-zone today, investors will focus on the US consumer inflation for August and weekly initial jobless claims data, both due to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.