For the 24 hours to 23:00 GMT, the EUR rose 0.25% against the USD and closed at 1.1986, shrugging off weak inflation numbers from the Euro-zone.

The Euro-zone’s preliminary consumer price index (CPI) advanced less-than-expected by 1.2% on an annual basis in April, after registering a rise of 1.3% in the prior month, thus threatening the European Central Bank’s (ECB) plan to end its asset purchases programme this year and hike interest rates in 2019. Market participants had envisaged the CPI to advance 1.3%. Meanwhile, the region’s producer price index (PPI) climbed 2.1% on an annual basis in March, meeting market expectations. The PPI had registered a rise of 1.6% in the previous month.

Separately, the European Commission, in its latest economic forecast report, projected that economic growth in the Euro-zone will moderate this year and next, after posting its fastest growth in a decade in 2017.

The Commission forecasted that economic expansion in the common currency region would slow to 2.3% this year, before slipping to 2.0% next year. Additionally, the Commission estimated that inflation in the Euro-bloc would accelerate to 1.5% this year and to 1.6% in 2019.

In the US, data indicated that trade deficit narrowed more-than-anticipated to $49.0 billion in March, hitting its lowest level since September 2017. The nation had registered a revised deficit of $57.7 billion in the prior month, while markets were expecting the nation to post a deficit of $50.0 billion. On the other hand, the nation’s ISM non-manufacturing PMI dropped to a 4-month low level of 56.8 in April, compared to market expectations for a fall to a level of 58.0. In the prior month, the PMI had registered a level of 58.8. Meanwhile, the nation’s final Markit services PMI was revised higher to a level of 54.6 in April, while the preliminary figures had indicated a rise to a level of 54.4. The PMI had recorded a level of 54.0 in the previous month.

In other economic news, final durable goods orders in the US grew 2.6% on a monthly basis in March, confirming the flash estimate and compared to a revised gain of 3.5% in the previous month. Also, the nation’s factory orders climbed 1.6% MoM in March, beating market consensus for an increase of 1.4% and following a revised similar rise in the previous month. Meanwhile, the number of Americans filing for fresh jobless claims climbed to a level of 211.0K in the week ended 28 April, undershooting market consensus for a rise to a level of 225.0K. In the previous week, initial jobless claims had recorded a level of 209.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1990, with the EUR trading slightly higher against the USD from yesterday’s close.

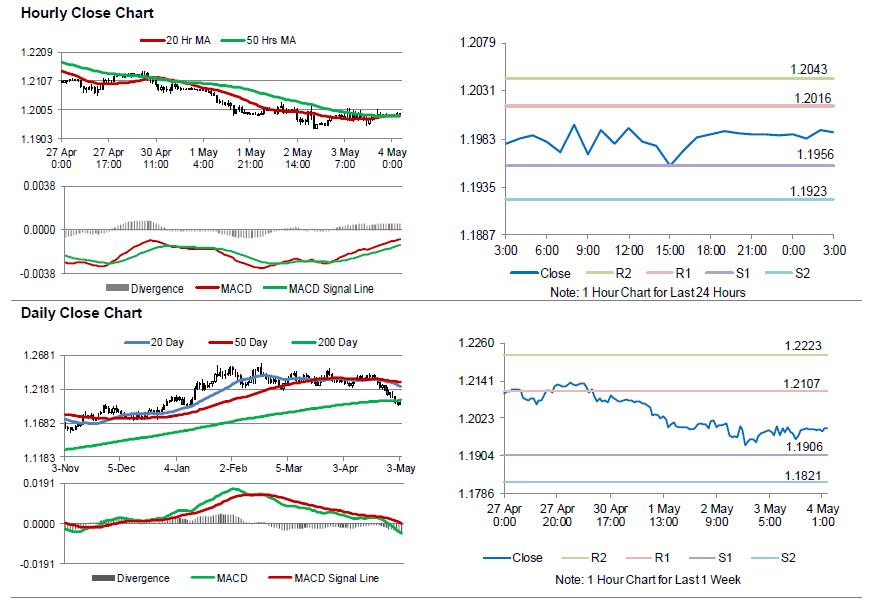

The pair is expected to find support at 1.1956, and a fall through could take it to the next support level of 1.1923. The pair is expected to find its first resistance at 1.2016, and a rise through could take it to the next resistance level of 1.2043.

Moving ahead, traders would keep a close watch on the final Markit services PMIs data for April, scheduled to release across the Euro-zone in a few hours. Additionally, the Euro-zone’s retail sales data for March, will also be on investors’ radar. Later in the day, all eyes would be on crucial US non-farm payrolls, average hourly earnings and unemployment rate data, all for April.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.