For the 24 hours to 23:00 GMT, the EUR declined 0.09% against the USD and closed at 1.1644.

On the data front, Euro-zone’s final consumer price index climbed 2.0% on an annual basis in June, at par with market expectations and confirming the preliminary print. The index had risen 1.9% in the prior month. Additionally, seasonally adjusted construction output rose 0.3% on a monthly basis in May. In the previous month, construction output had recorded a revised rise of 1.40%.

In the US, data revealed that building permits unexpectedly fell by 2.2% on a monthly basis to an annual rate of 1273.0K in June, for the third consecutive month and defying market consensus for a rise to a level of 1330.0K. In the preceding month, building permits had recorded a level of 1301.0K. Further, housing starts plunged 12.3% on a monthly basis to an annual rate of 1173.0K in June, reaching a 9-month low level and compared to market expectations for a drop to a level of 1320.0K. Housing starts had posted a revised level of 1337.0K in the prior month. Moreover, the nation’s MBA mortgage applications eased 2.5% in the week ended 13 July 2018, compared to an advance of 2.5% in the previous week.

Meanwhile, according to the Federal Reserve’s (Fed) Beige Book report, economic activity in the US continued to expand at a moderate pace in June. Further, it revealed that overall prices and employment increased at a modest to moderate pace. However, businesses expressed concerns over tariffs and new trade policies.

In the Asian session, at GMT0300, the pair is trading at 1.1646, with the EUR trading a tad higher against the USD from yesterday’s close.

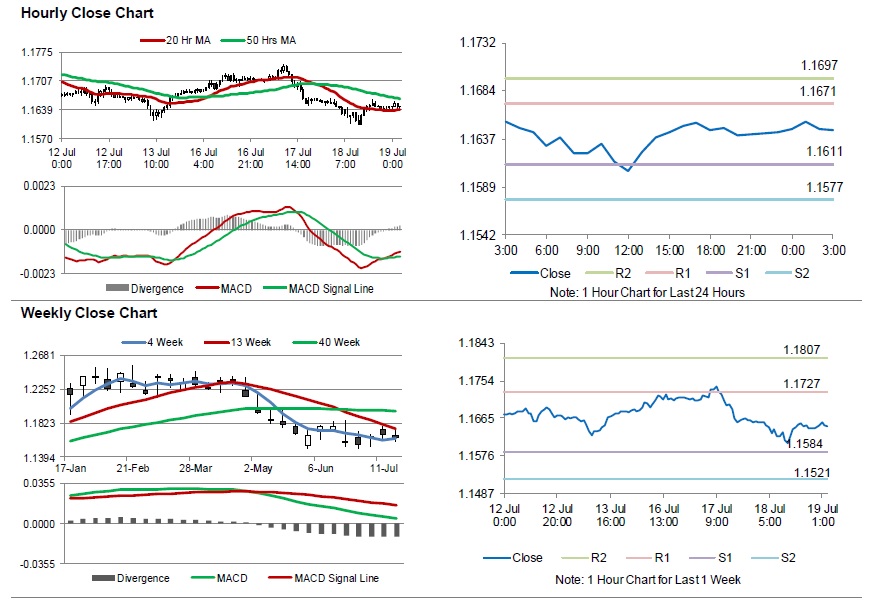

The pair is expected to find support at 1.1611, and a fall through could take it to the next support level of 1.1577. The pair is expected to find its first resistance at 1.1671, and a rise through could take it to the next resistance level of 1.1697.

Amid no major macroeconomic releases in the Euro-zone today, investors would look forward to the US initial jobless claims followed by the Philadelphia Fed manufacturing survey for July and the leading index for June, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.