For the 24 hours to 23:00 GMT, the EUR declined 0.71% against the USD and closed at 1.0951.

On the macro front, Euro-zone’s Markit manufacturing PMI dropped to a level of 44.5 in March, due to the coronavirus outbreak and hitting its lowest level in 92 months. In the previous month, the index had recorded a reading of 49.2 in the previous month. The preliminary figures had indicated a fall to 44.8. Meanwhile, unemployment rate unexpectedly dropped to 7.3% in February, reaching its lowest rate since March 2008 and confounding market expectations for a rise to 7.4%. In the prior month, the unemployment rate stood at 7.4%. Separately, Germany’s retail sales advanced 1.2% on a monthly basis in February, as households started stockpiling ahead of anticipated lock-down and quarantine measures compared to a revised rise of 1.0% in the earlier month. Market participants were expecting retail sales to record a flat reading. On the other hand, the Markit manufacturing PMI eased to a level of 45.4 in March, compared to a reading of 48.0 in the previous month. The preliminary figures had indicated a drop to a level of 45.7.

In the US, the MBA mortgage applications jumped 15.3% on a weekly basis in the week ended 27 March 2020, compared to a plunge of 29.4% in the previous week. On the contrary, the ISM manufacturing PMI dropped to a level of 49.1 in March, less than market expectations for a drop to a level of 45.0 and compared to a reading of 50.1 in the previous month. On the flipside, the Markit manufacturing PMI unexpectedly fell to a level of 48.5 in March, hitting its lowest level since August 2009 and compared to a reading of 50.7. The preliminary figures had indicated a fall to 49.2. Additionally, construction spending unexpectedly declined 1.3% on a monthly basis in February. Construction spending had recorded a revised rise of 2.8% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0934, with the EUR trading 0.16% lower against the USD from yesterday’s close.

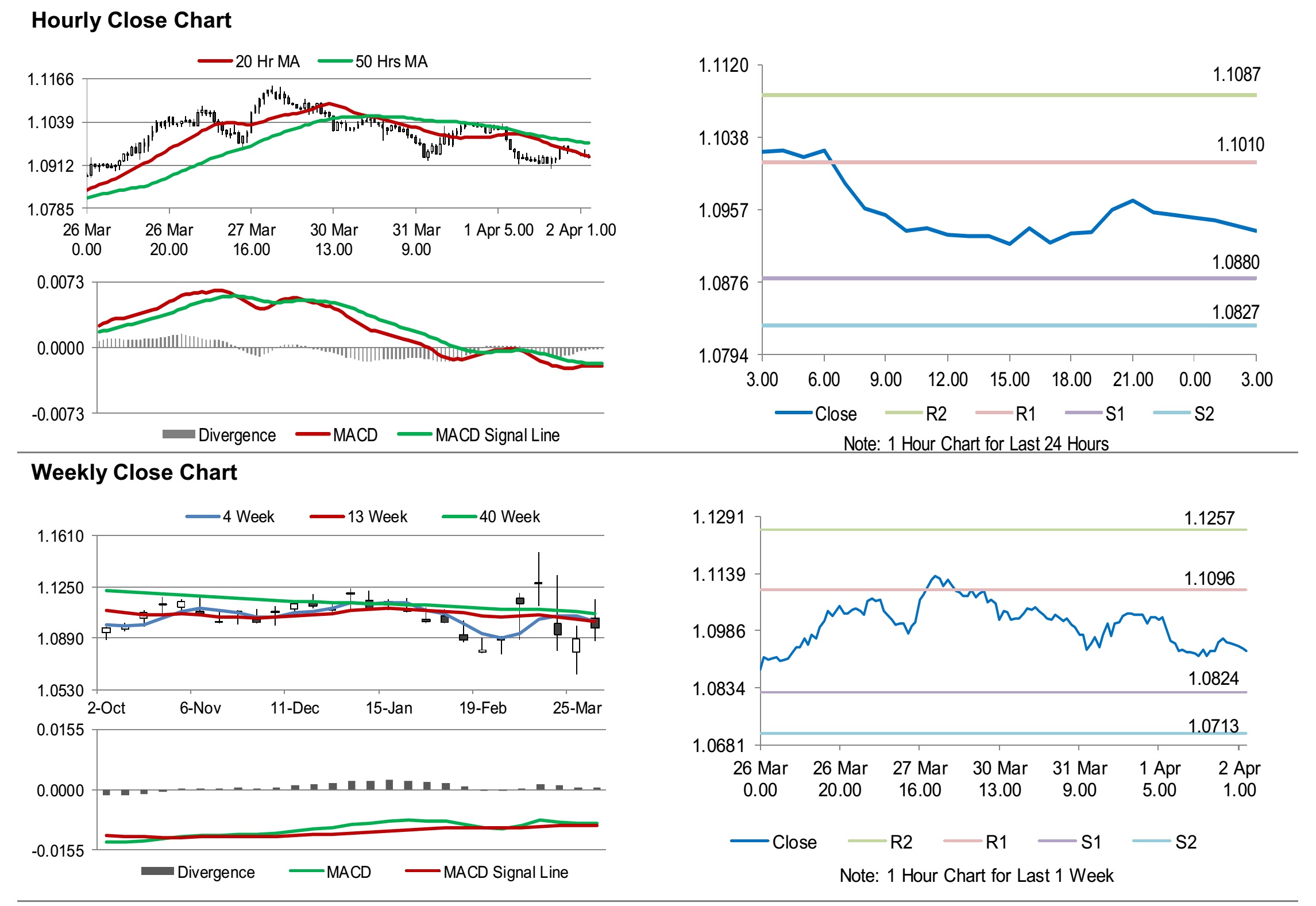

The pair is expected to find support at 1.0880, and a fall through could take it to the next support level of 1.0827. The pair is expected to find its first resistance at 1.1010, and a rise through could take it to the next resistance level of 1.1087.

Looking forward, traders would keep a watch on Euro-zone’s producer price index for February, slated to release in a few hours. Later in the day, the US trade balance, durable goods orders and factory orders, all for February as well as initial jobless claims, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.