For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1683.

On the macro front, the Euro-zone’s flash Markit manufacturing PMI unexpectedly advanced to a level of 55.1 in July, defying market expectations for a drop to a level of 54.6. In the prior month, the PMI had recorded a reading of 54.9. On the contrary, the region’s flash Markit services PMI declined more-than-expected to a level of 54.4 in July, recording its weakest reading since November 2016 and compared to a level of 55.2 in the previous month. Markets had envisaged the PMI to drop to a level of 55.0.

Separately, Germany’s flash Markit manufacturing PMI unexpectedly climbed to a 3-month high level of 57.3 in July, while investors had envisaged the PMI to fall to 55.5. In the previous month, the PMI had registered a reading of 55.9. On the other hand, the nation’s preliminary Markit services PMI fell slightly to a level of 54.4 in July, compared to a reading of 54.5 in the prior month. Market participants had expected the PMI to remain unchanged.

In the US, data showed that, the US flash Markit manufacturing PMI unexpectedly rose to a level of 55.5 in July, defying market expectations for a fall to a level of 55.1. In the preceding month, the PMI had registered a level of 55.4. Meanwhile, the nation’s flash Markit services PMI dropped to a level of 56.2 in July, after registering a reading of 56.5 in the prior month. Market consensus was for the PMI to decline to a level of 56.3.

Furthermore, the US house price index advanced 0.2% on a monthly basis in May, undershooting market expectations for a rise of 0.3%. In the prior month, the index had registered a revised similar rise.

Separately, the nation’s Richmond Fed manufacturing index slid less than expected to 20.0 in July, compared to a revised reading of 21.0 in the previous month. Market participants had anticipated the index to ease to a level of 18.00.

In the Asian session, at GMT0300, the pair is trading at 1.1683, with the EUR trading flat against the USD from yesterday’s close.

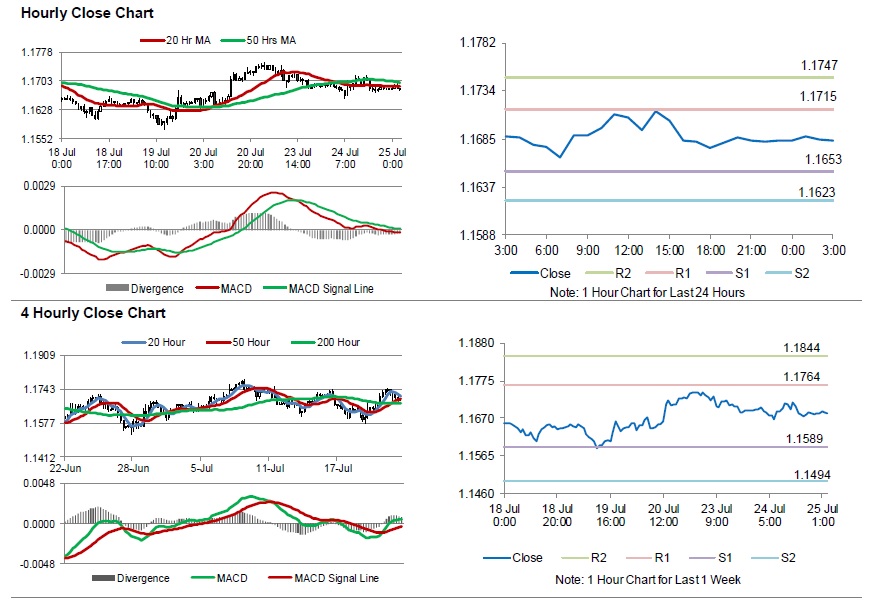

The pair is expected to find support at 1.1653, and a fall through could take it to the next support level of 1.1623. The pair is expected to find its first resistance at 1.1715, and a rise through could take it to the next resistance level of 1.1747.

Looking ahead, investors will await Germany’s IFO business climate and expectations indices for July, set to release in a few hours. Also, the US MBA mortgage applications followed by new home sales data for June, will be on investors radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.