For the 24 hours to 23:00 GMT, the EUR declined 0.47% against the USD and closed at 1.1307 on Friday, as weak private sector data from Germany and France for December signalled a slowdown in the Euro-zone.

Macroeconomic data showed that the Euro-zone’s flash manufacturing PMI unexpectedly declined to a 34-month low level of 51.4 in December, defying market consensus for a flat reading. In the prior month, the PMI had recorded a reading of 51.8. Moreover, the region’s preliminary services PMI surprisingly dropped to a level of 51.4 in December, marking its lowest level in 49-months and cofounding market expectations for a steady reading. In the previous month, the PMI had registered a level of 53.4.

Separately in Germany, the preliminary manufacturing PMI expanded at its weakest pace in 33-months to a level of 51.5 in December. The PMI had recorded a reading of 51.8 in the preceding month. Also, the nation’s flash services PMI unexpectedly slid to a four-year low level of 52.5 in December. In the prior month, the PMI had recorded a reading of 53.3. Meanwhile, French private sector activity for December entered into contractionary territory for the first time in two-and-a-half years, amid widespread reports of disruption to business due to the Yellow Vests anti-government protests.

In the US, data showed that the US Markit manufacturing PMI fell to a 13-month low level of 53.9 in December, weighed down by losses in new orders and employment. The PMI had registered a reading of 55.3 in the prior month, while markets had anticipated for a drop to a level of 55.0. Additionally, the nation’s Markit services PMI declined to a level of 53.4 in December, hitting its lowest level in 11-months. In the previous month, the PMI had registered a reading of 54.7. On the other hand, the US advance retail sales climbed 0.2% on a monthly basis in November, beating market expectations for a rise of 0.1%. In the preceding month, advance retail sales had recorded a revised rise of 1.1%. Furthermore, the industrial production advanced 0.6% on a monthly basis in November, compared to a revised decline of 0.2% in the prior month. Meanwhile, the nation’s manufacturing production registered a flat reading in November.

In the Asian session, at GMT0400, the pair is trading at 1.1311, with the EUR trading a tad higher against the USD from Friday’s close.

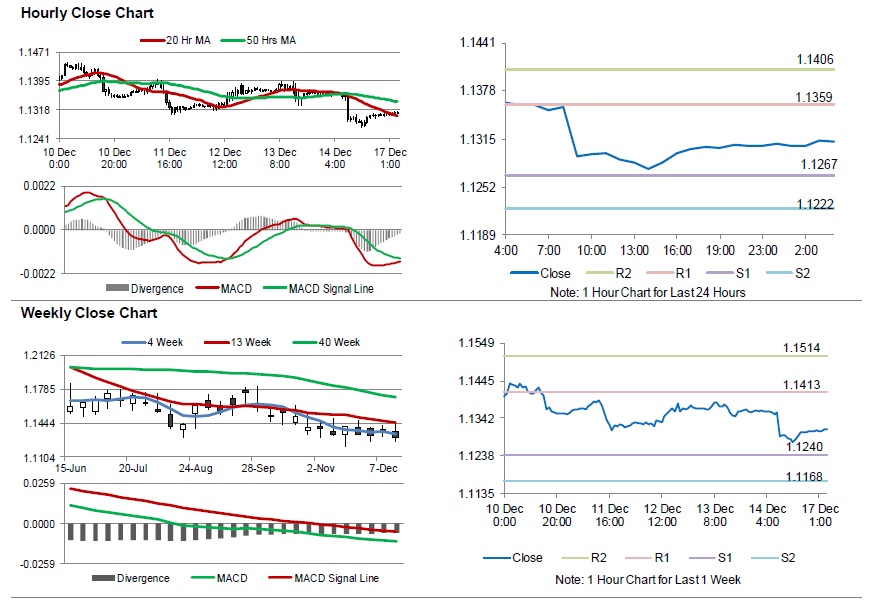

The pair is expected to find support at 1.1267, and a fall through could take it to the next support level of 1.1222. The pair is expected to find its first resistance at 1.1359, and a rise through could take it to the next resistance level of 1.1406.

Moving ahead, traders would keep an eye on the Euro-zone’s consumer price index for November and trade balance data for October, set to release in a few hours. Later in the day, the US empire manufacturing and NAHB housing market index, both for December, will be on investors’ radar.

The currency pair is trading in between its 20 Hr and 50 Hr moving averages.