For the 24 hours to 23:00 GMT, the EUR rose 0.25% against the USD and closed at 1.1850, after the latest set of economic data suggested that robust economic recovery across the single currency bloc is gathering further momentum.

Data indicated that the Euro-zone’s flash Markit manufacturing PMI unexpectedly climbed to a level of 60.0 in November, defying market expectations for a fall to a level of 58.2. The PMI had registered a level of 58.5 in the prior month. Further, the region’s preliminary Markit services PMI advanced more-than-anticipated to a level of 56.2 in November, notching a six-month high level. The PMI had registered a reading of 55.0 in the prior month, while markets were expecting for a rise to a level of 55.2.

Separately, Germany’s manufacturing sector activity surprisingly accelerated to a seven-year high level of 62.5 in November, compared to a level of 60.6 in the prior month. Market participants had envisaged the manufacturing PMI to drop to a level of 60.4. Moreover, growth in the nation’s services sector advanced to a level of 54.9 in November, undershooting market expectations of an increase to a level of 55.0. In the prior month, the PMI had recorded a level of 54.7.

Other data indicated that Germany’s seasonally adjusted final gross domestic product (GDP) rose 0.8% on a quarterly basis in the third quarter of 2017, confirming the preliminary print and compared to a rise of 0.6% in the previous quarter.

Meanwhile, minutes of the European Central Bank’s (ECB) October policy meeting indicated a broad agreement among officials on extending the central bank’s quantitative easing (QE) programme. Nevertheless, minutes highlighted that policymakers were divided over whether to announce an end-date to QE as some concerns were expressed that the open-ended nature might generate expectations of further extensions. However, with inflation dynamics remaining subdued, board members agreed that an ample degree of monetary stimulus was still needed to secure a sustained return of inflation towards the central bank’s target.

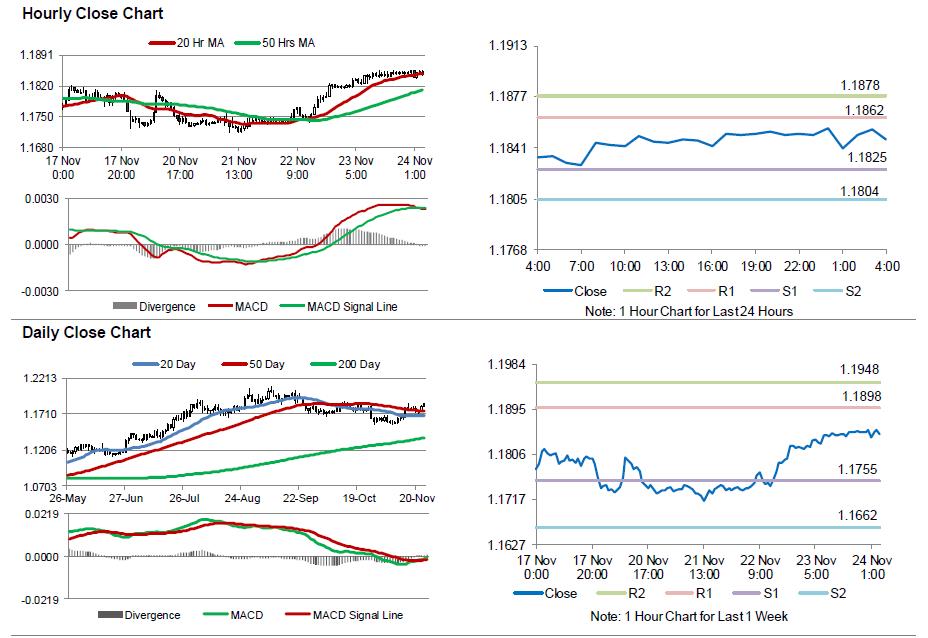

In the Asian session, at GMT0400, the pair is trading at 1.1847, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1825, and a fall through could take it to the next support level of 1.1804. The pair is expected to find its first resistance at 1.1862, and a rise through could take it to the next resistance level of 1.1878.

Moving ahead, market participants would closely monitor Germany’s Ifo expectations and business climate indices for November, slated to release in a few hours. Moreover, in the US, the flash Markit manufacturing and services PMIs for November, set to release later in the day, will pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.