For the 24 hours to 23:00 GMT, the EUR declined 0.55% against the USD and closed at 1.1289.

On the data front, the Euro-zone’s final manufacturing PMI unexpectedly dropped to a level of 47.6 in June, contracting for the fifth consecutive month and compared to a reading of 47.7 in the prior month. Market participants and preliminary figures had indicated the PMI to record a rise to a level of 47.8. Meanwhile, the region’s unemployment rate surprisingly fell to 7.5% in May, defying market consensus for a steady reading. In the previous month, the unemployment rate had recorded a reading of 7.6%.

Separately, in Germany, the Markit final manufacturing PMI contracted for the sixth straight month to a level of 45.0 in June, less than market anticipation and preliminary figures for a rise to a level of 45.4. In the prior month, the PMI had recorded a level of 44.3. However, the nation’s seasonally adjusted unemployment rate remained steady at 5.0% in June, in line with market expectations.

In the US, data showed that the final Markit manufacturing PMI unexpectedly advanced to a level of 50.6 in June, defying market expectations and preliminary figures for a fall to a level of 50.1. In the preceding month, the PMI had recorded a level of 50.5.

On the other hand, the US ISM manufacturing activity index eased to a level of 51.7 in June, expanding at its weakest pace since October 2016, amid worries over ongoing tariff war. In the prior month, the PMI had recorded a reading of 52.1. Market participants had envisaged the index to record a drop to a level of 51.0. Further, the nation’s construction spending surprisingly slid 0.8% on a monthly basis in May, defying market expectations for an unchanged reading. In the previous month, construction spending had recorded a revised rise of 0.4%.

In the Asian session, at GMT0300, the pair is trading at 1.1280, with the EUR trading 0.08% lower against the USD from yesterday’s close.

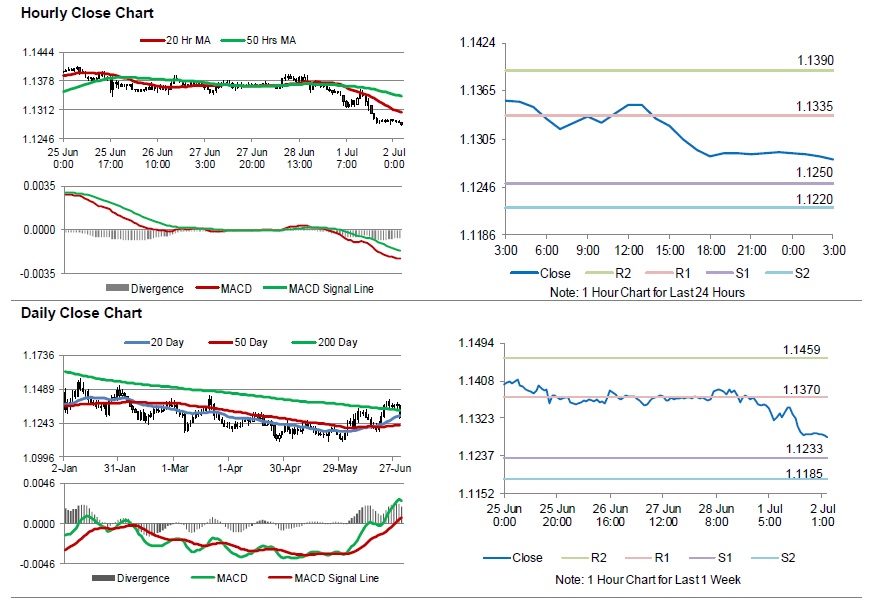

The pair is expected to find support at 1.1250, and a fall through could take it to the next support level of 1.1220. The pair is expected to find its first resistance at 1.1335, and a rise through could take it to the next resistance level of 1.1390.

Moving ahead, traders would keep an eye on Euro-zone’s producer price index for May along with Germany’s retail sales for May, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.