For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1336, on the back of dismal PMI data.

Data showed that Euro-zone’s flash manufacturing PMI fell to a level of 49.2 in February, declining to a 68-month low level and compared to market expectations for a drop to a level of 50.3. In the previous month, the PMI had registered a reading of 50.5.

On the flipside, the region’s preliminary services PMI climbed to a 3-month high level of 52.3 in February, following a level of 51.2 in the prior month. Market participants had envisaged the PMI to advance to a level of 51.3.

Separately, in Germany, the preliminary manufacturing PMI unexpectedly declined for the first time since 2013 to a level of 47.6 in February, defying market consensus for a rise to a level of 49.9. In the prior month, the PMI had recorded a level of 49.7. However, the nation’s the preliminary services PMI surprisingly rose to a 5-month high level of 55.1 in February, cofounding market anticipations for a drop to a level of 52.9. In the previous month, the PMI had recorded a level of 53.0. Meanwhile, Germany’s final consumer price inflation slowed to a 11-month low level of 1.4% on an annual basis in January, in line with market expectations and confirming the preliminary print. In the prior month, the inflation had registered a level of 1.7%.

In the US, data indicated that the US Philadelphia Fed manufacturing index slid to a level of -4.1 in February, compared to market expectations for a drop to a level of 14.0. The index had recorded a reading of 17.0 in the prior month. Moreover, the nation’s flash Markit manufacturing PMI slid to a 17-month low level of 53.7 in February, higher than market anticipations for a decline to a level of 54.8. In the prior month, the index gad registered a reading of 54.9. Additionally, the US existing home sales unexpectedly dropped to a 3-year low level of 1.2% on a monthly basis to a level of 4.94 million in January, falling short of market consensus for a reading of 5.0 million. In the prior month, existing home sales had recorded a revised level of 5.0 million. On the contrary, the US flash Markit services PMI advanced to a level of 56.2 in February, compared to a level of 54.2 in the previous month. Market participants had envisaged the PMI to rise to a level of 54.3. Furthermore, the nation’s flash durable goods orders jumped 1.2% on a monthly basis in December, undershooting market consensus for a rise of 1.7%. In the prior month, durable goods orders had recorded a gain of 0.7%. Also, the number for Americans filling for fresh unemployment benefits declined to a level of 216.0K in the week ended 16 February 2019, compared to a level of 239.0K in the prior week. Markets had anticipated the initial jobless claims to drop to 228.0K.

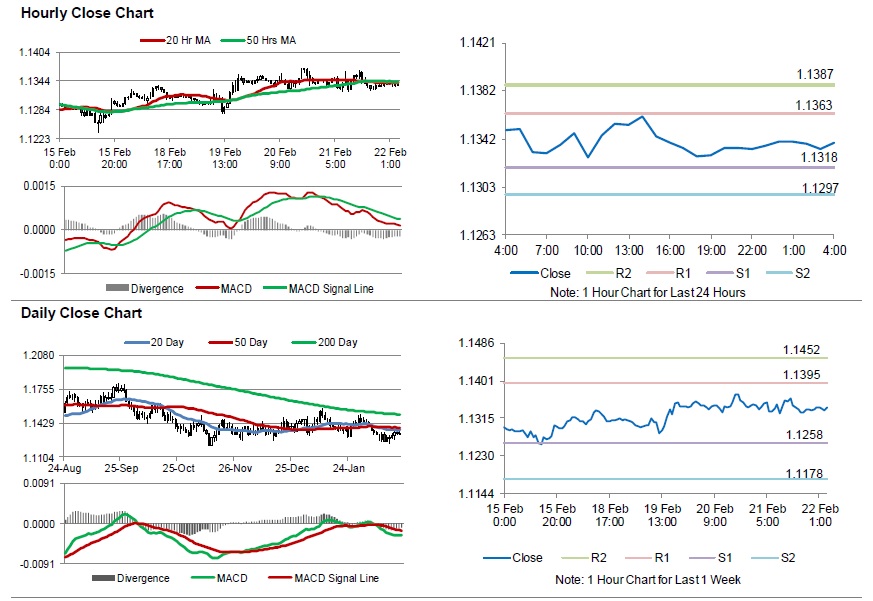

In the Asian session, at GMT0400, the pair is trading at 1.1339, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1318, and a fall through could take it to the next support level of 1.1297. The pair is expected to find its first resistance at 1.1363, and a rise through could take it to the next resistance level of 1.1387.

Looking forward, traders would keep an eye on the Euro-zone’s consumer price index for January along with Germany’s 4Q gross domestic product and the IFO survey indices for February, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.