For the 24 hours to 23:00 GMT, the EUR rose 0.43% against the USD and closed at 1.1814, following robust economic data from across the Euro-zone.

Data indicated that the Euro-zone’s flash Markit manufacturing PMI unexpectedly advanced to a level of 57.4 in August, expanding at its fastest pace in two months, indicating that manufacturing sector continues to be one of the important bellwether for the region’s economic recovery. Market participants had expected the PMI to drop to a level of 56.3, following a reading of 56.6 in the prior month. On the contrary, the region’s preliminary Markit services PMI unexpectedly fell to a seven-month low level of 54.9 in August, while markets were anticipating it to remain steady at a level of 55.4 registered in the previous month.

In other economic news, the flash consumer confidence index in the common currency region unexpectedly improved to a level of -1.5 in August, compared to a level of -1.7 in the prior month. Markets were anticipating the index to ease to a level of -1.8.

Separately, Germany’s manufacturing sector growth unexpectedly jumped to a level of to 59.4 in August, confounding market consensus for a decline to a level of 57.6. In the preceding month, the PMI had registered a reading of 58.1. Moreover, activity in the nation’s services sector expanded more-than-expected to a level of 53.4 in August, compared to a reading of 53.1 in the prior month, while markets were expecting the PMI to rise to a level of 53.3.

The greenback lost ground against a basket of currencies, as the US President, Donald Trump’s warning of a government shutdown dampened investor sentiment.

The US President vowed that he will shut down government if he does not get funding to build a border wall with Mexico. Further, Trump also threatened of possible termination of the North American Free Trade Agreement (NAFTA).

Meanwhile, Fitch Ratings warned that failure of the US government to raise the debt ceiling in a timely manner would prompt it to review its rating on US sovereign debt for a possible downgrade.

On the macro front, the US preliminary Markit manufacturing PMI unexpectedly eased to a 2-month low level of 52.5 in August, defying market expectation for a rise to a level of 53.5 and compared to a reading of 53.3 in the previous month. On the other hand, the nation’s flash Markit services PMI rose to a level of 56.9 in August, topping market expectations of an advance to a level of 55.0. In the prior month, the PMI had recorded a level of 54.7.

Other data showed that new home sales in the US sharply fell by 9.4% on monthly basis, to a level of 571.0K in July, compared to a revised reading of 630.0K in the previous month, while market participants had envisaged it to drop to a level of 610.0K. Also, the nation’s mortgage applications slid 0.5% in the week ended 18 August. In the prior week, mortgage applications had risen 0.1%.

In the Asian session, at GMT0300, the pair is trading at 1.1804, with the EUR trading 0.08% lower against the USD from yesterday’s close.

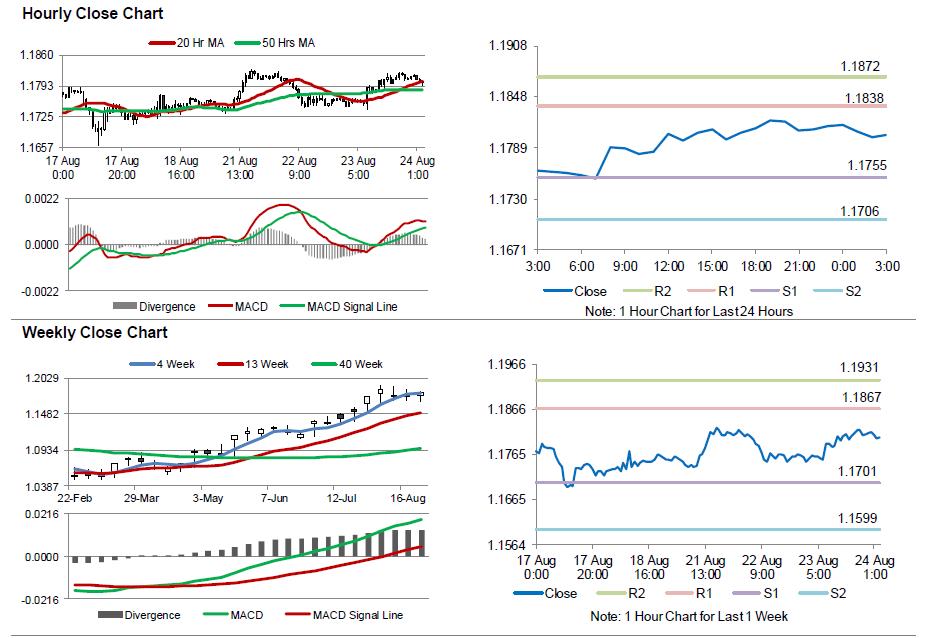

The pair is expected to find support at 1.1755, and a fall through could take it to the next support level of 1.1706. The pair is expected to find its first resistance at 1.1838, and a rise through could take it to the next resistance level of 1.1872.

In absence of any major macroeconomic releases in the Euro-zone today, traders will pay attention to the US weekly jobless claims followed by existing home sales data for July, both scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.