For the 24 hours to 23:00 GMT, the EUR declined 0.24% against the USD and closed at 1.2272, following a slowdown in manufacturing sector activity across the Euro-zone.

The Euro-zone’s final Markit manufacturing PMI declined to an 8-month low level of 56.6 in March, confirming the preliminary figures. In the prior month, the PMI had registered a level of 58.6.

Separately, Germany’s final Markit manufacturing PMI dropped more than initially estimated to a level of 58.2 in March, hitting its lowest level in more than a year. In the previous month, the PMI had recorded a reading of 60.6, while the flash estimate had recorded a fall to a level of 58.4. Further, the nation’s retail sales unexpectedly fell by 0.7% on a monthly basis in February, declining for the third straight month and dampening hopes that private consumption will propel growth in Euro-bloc’s largest economy in the first quarter of 2018. In the preceding month, retail sales had fallen by a revised 0.3%, while investors had envisaged for a gain of 0.7%.

In the Asian session, at GMT0300, the pair is trading at 1.2281, with the EUR trading 0.07% higher against the USD from yesterday’s close.

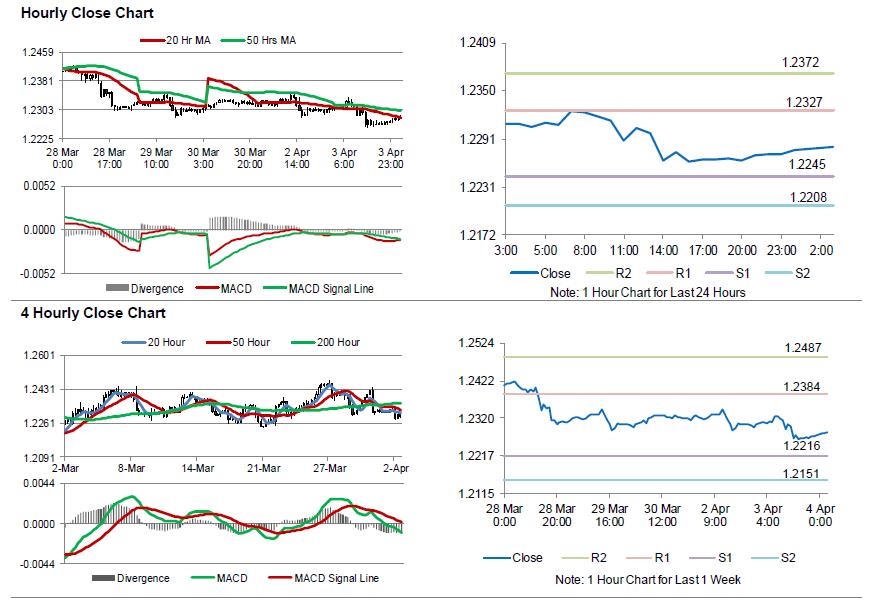

The pair is expected to find support at 1.2245, and a fall through could take it to the next support level of 1.2208. The pair is expected to find its first resistance at 1.2327, and a rise through could take it to the next resistance level of 1.2372.

Going ahead, traders would closely monitor the Euro-zone’s flash inflation figures for March and unemployment rate data for February, both scheduled to release in a few hours. Later in the day, the release of US ADP employment change, the ISM non-manufacturing index as well as the final Markit manufacturing PMI, all for March, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.