For the 24 hours to 23:00 GMT, the EUR declined 0.55% against the USD and closed at 1.0459.

In economic news, data revealed that the Euro-zone’s final Markit manufacturing PMI was confirmed at its highest level in more than five years of 54.9 in December, meeting market expectations, suggesting that the region’s manufacturing sector ended the year on a stronger footing.

Separately, in Germany, activity in the manufacturing sector was surprisingly revised upwards to a level of 55.6 in December, expanding at its fastest pace in three years and defying market expectations for the index to remain steady at a level of 55.5, recorded in the preliminary print.

On Friday, data showed that the US Chicago purchasing managers’ index dropped more-than-expected to a level of 54.6 in December, against a level of 57.6 in the previous month, while markets were anticipating the index to ease to a level of 56.8.

In the Asian session, at GMT0400, the pair is trading at 1.0483, with the EUR trading 0.23% higher against the USD from yesterday’s close.

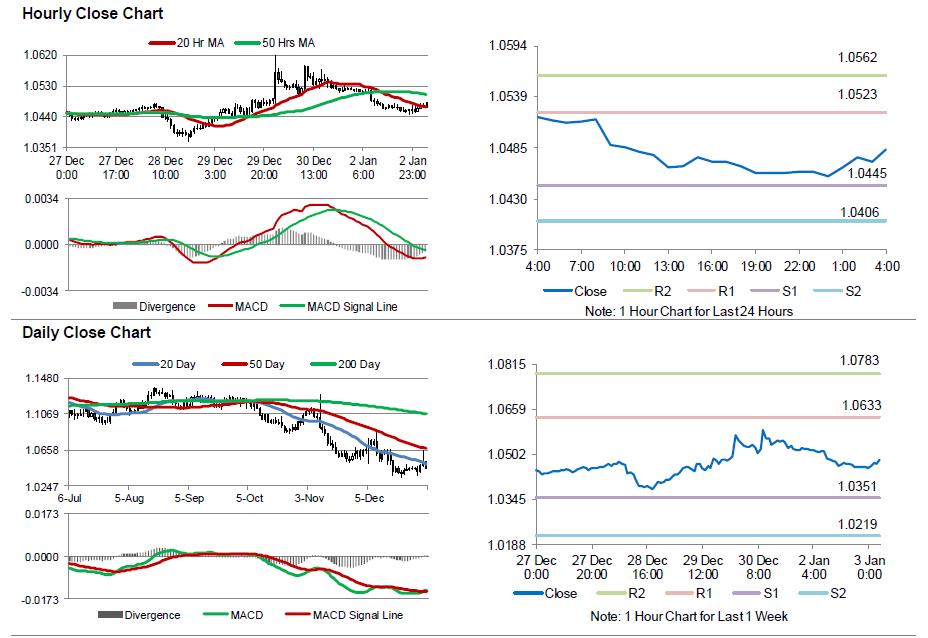

The pair is expected to find support at 1.0445, and a fall through could take it to the next support level of 1.0406. The pair is expected to find its first resistance at 1.0523, and a rise through could take it to the next resistance level of 1.0562.

Moving ahead, market participants will look forward to Germany’s unemployment rate and flash consumer price index, both for December, slated to release in a few hours, to gauge strength in the Euro-zone’s economic powerhouse. Additionally, the US ISM manufacturing and the final Markit manufacturing PMIs, both for December, along with construction spending for November, all slated to release later in the day, will be keenly watched by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.