For the 24 hours to 23:00 GMT, the EUR declined 0.87% against the USD and closed at 1.1346, amid weak manufacturing PMI data across the euro-bloc.

Macroeconomic data showed that the Euro-zone’s final manufacturing PMI dropped to a 34-month low level to 51.4 in December, at par with market expectations and confirming the preliminary print. In the prior month, the PMI had recorded a reading of 51.8.

Separately, in Germany, the final Markit manufacturing PMI fell to a level of 51.5 in December, hitting its lowest level in 33-months and confirming the preliminary print. In the previous month, the PMI had registered a level of 51.8.

In the US, data indicated that the US final Markit manufacturing PMI declined to a level of 53.8 in December, amid slowdown in growth of new businesses and notching its lowest level in 15 months. Market participants had envisaged the PMI to drop to a level of 53.9. In the preceding month, the PMI had registered a reading of 55.3.

In the Asian session, at GMT0400, the pair is trading at 1.1363, with the EUR trading 0.15% higher against the USD from yesterday’s close.

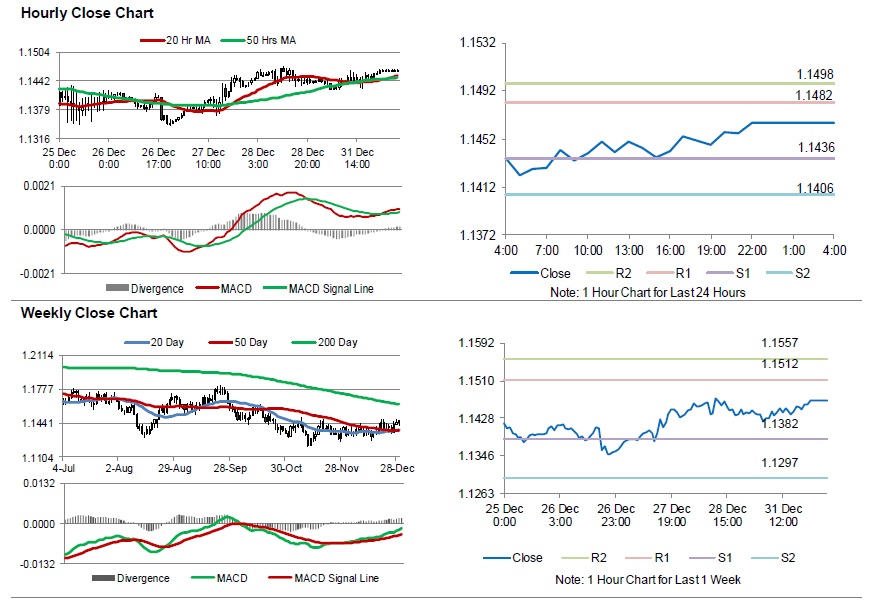

The pair is expected to find support at 1.1282, and a fall through could take it to the next support level of 1.1202. The pair is expected to find its first resistance at 1.1470, and a rise through could take it to the next resistance level of 1.1578.

Amid no major economic releases across the euro bloc, investors would keep an eye on US construction spending for November and ISM manufacturing for December, along with initial jobless claims, due to release later in the day. Additionally, the ADP employment change data for November, will also be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.