For the 24 hours to 23:00 GMT, the EUR rose 0.38% against the USD and closed at 1.1897, after robust jobs data in the Euro-zone boosted investor sentiment.

The Euro-zone’s unemployment rate surprisingly declined to 8.8% in October, hitting its lowest level since January 2009, thus suggesting that the region’s jobs market has gathered further strength. Market participants had expected the region’s unemployment rate to remain steady at 8.9%.

However, the region’s flash consumer price index (CPI) advanced less-than-anticipated by 1.5% on an annual basis in November, thus justifying the European Central Bank’s (ECB) cautious approach on monetary policy, as the nascent economic recovery across the common currency region has been struggling to prop-up inflation. The CPI had registered a rise of 1.4% in the previous month, while markets had anticipated for an increase of 1.6%.

Another set of data indicated that Germany’s seasonally adjusted unemployment rate remained steady at a record low of 5.6% in November, at par with market expectations. On the other hand, the nation’s retail sales unexpectedly retreated 1.2% on a monthly basis in October, confounding market consensus for an advance of 0.3%, thus highlighting that weak wage growth has curtailed the nation’s household spending. In the previous month, retail sales had climbed 0.5%.

The greenback erased some of its losses against its major counterparts, amid renewed optimism over the US tax reforms after John McCaine, a rebel senator, declared his support for the Republican tax bill.

On the economic front, the number of Americans filing for fresh jobless claims unexpectedly dropped to a level of 238.0K in the week ended 25 November, following a revised reading of 240.0K in the prior week. Markets were anticipating initial jobless claims to record a steady reading. Moreover, the nation’s personal spending rose 0.3% on a monthly basis in October, meeting market consensus and compared to a revised increase of 0.9% in the previous month. Further, the nation’s personal income rose 0.4% MoM in October, beating market expectations for a gain of 0.3%. In the prior month, personal income had registered a rise of 0.4%.

On the contrary, the nation’s Chicago Fed PMI dropped to a three-month low level of 63.9 in November, more than market expectations for a fall to a level of 63.0. In the previous month, the index had registered a level of 66.2.

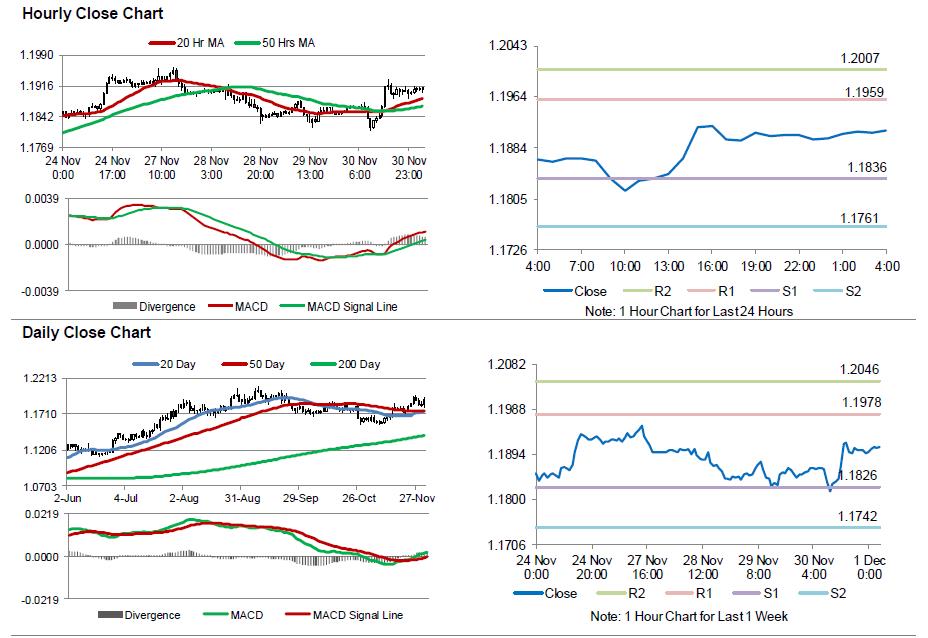

In the Asian session, at GMT0400, the pair is trading at 1.1911, with the EUR trading 0.12% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1836, and a fall through could take it to the next support level of 1.1761. The pair is expected to find its first resistance at 1.1959, and a rise through could take it to the next resistance level of 1.2007.

Ahead in the day, traders would look forward to the release of final Markit manufacturing PMI for November across the Euro-zone, scheduled in a few hours. Moreover, the US ISM manufacturing and the final Markit manufacturing PMIs for November as well as construction spending data for October, set to release later in the day, will garner significant amount of investor attraction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.