For the 24 hours to 23:00 GMT, the EUR rose 0.60% against the USD and closed at 1.1478.

On macro front, the Euro-zone’s Sentix investor confidence index fell for the fifth consecutive month to a four-year low level of -1.5 in January, compared to a level of -0.3 in the prior month. Market participants had expected the index to drop to a level of -2.0. On the other hand, the region’s seasonally adjusted retail sales climbed 1.1% on a yearly basis in November, rising for the second straight month and overshooting market consensus for a gain of 0.4%. Retail sales had recorded a revised rise of 2.3% in the previous month.

Separately, in Germany, retail sales unexpectedly rose 1.1% on an annual basis in November, advancing at its strongest pace in seven months and cofounding market anticipations for a decline of 0.4%. Retail sales climbed 5.0% in the prior month. Meanwhile, the nation’s seasonally adjusted factory orders retreated 1.0% on a monthly basis in November, declining for the first time in four-months and more than market expectations for a drop of 0.1%. In the previous month, factory orders had registered a revised rise of 0.2%.

In the US, data revealed that the US non-manufacturing PMI declined to a 5-month low level of 57.6 in December, compared to a level of 60.7 in the previous month. Market participants had anticipated the PMI to decrease to a level of 58.5.

In the Asian session, at GMT0400, the pair is trading at 1.1435, with the EUR trading 0.37% lower against the USD from yesterday’s close.

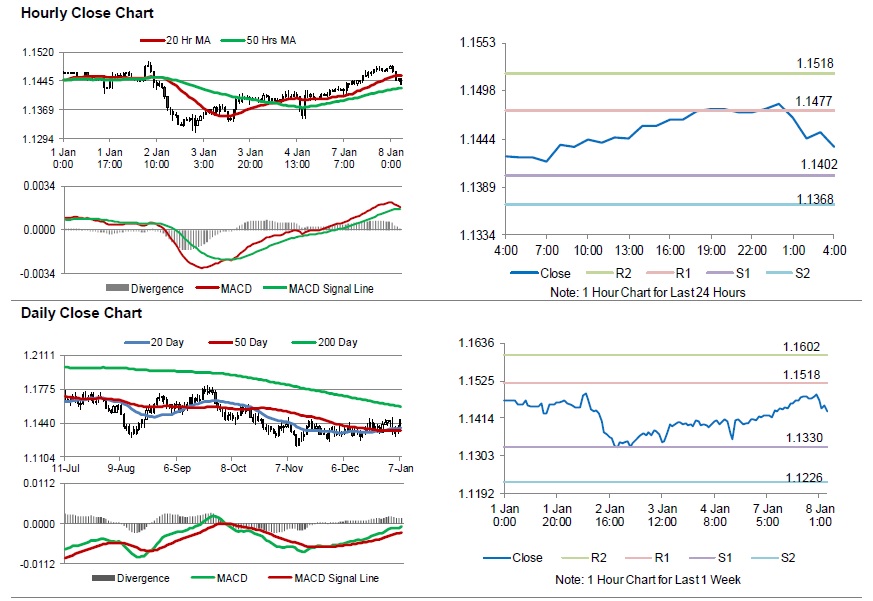

The pair is expected to find support at 1.1402, and a fall through could take it to the next support level of 1.1368. The pair is expected to find its first resistance at 1.1477, and a rise through could take it to the next resistance level of 1.1518.

Looking ahead, traders would await the Euro-zone’s consumer confidence, economic confidence, industrial confidence and business climate indicator, all for December, along with Germany’s industrial production November, all set to release in a few hours. Later in the day, the US trade balance and consumer credit data, both for November, along with the NFIB small business optimism index for December, will garner significant amount of investor attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.