For the 24 hours to 23:00 GMT, the EUR rose 0.84% against the USD and closed at 1.0980, amid expectations that the centrist candidate, Emmanuel Macron, will win the second and final round of French presidential election, scheduled on Sunday.

Euro added to gains following the release of upbeat services sector data in the Euro-zone. The final Markit services PMI in the Euro-zone was revised higher to a level of 56.4 in April, from a flash estimate of 56.2, maintaining its six-year high level, thus indicating that the regional economy is off to a strong start in the second quarter. The PMI had recorded a level of 56.0 in the previous month. Additionally, the region’s seasonally adjusted retail sales advanced more-than-expected by 0.3% MoM in March, compared to a revised rise of 0.5% in the previous month, while markets expected for a gain of 0.1%.

Separately, growth in Germany’s services sector fell less than initially estimated to a level of 55.4 in April, compared to a drop to a level of 54.7 registered in the preliminary print. In the previous month, the PMI had recorded a reading of 55.6.

Macroeconomic data released in the US showed that the number of Americans filing for fresh jobless claims fell to a three-week low level of 238.0K in the week ended 29 April 2017 and higher than market consensus for a drop to a level of 248.0K. In the previous week, initial jobless claims had recorded a level of 257.0K. Additionally, the nation’s trade deficit surprisingly narrowed to a level of $43.7 billion in March, compared to a revised deficit of $43.8 billion in the prior month, while market participants had envisaged the nation’s deficit to widen to a level of $44.5 billion. Moreover, the nation’s factory orders rose less-than-anticipated by 0.2% MoM in March, compared to a revised rise of 1.2% in the prior month. Markets were anticipating factory orders to rise 0.4%. Further, the nation’s final durable goods orders climbed 0.9% in March, advancing for the third consecutive month, compared to a revised rise of 2.3% in the prior month. The preliminary figures had indicated a rise of 0.7%.

In the Asian session, at GMT0300, the pair is trading at 1.0976, with the EUR trading slightly lower against the USD from yesterday’s close.

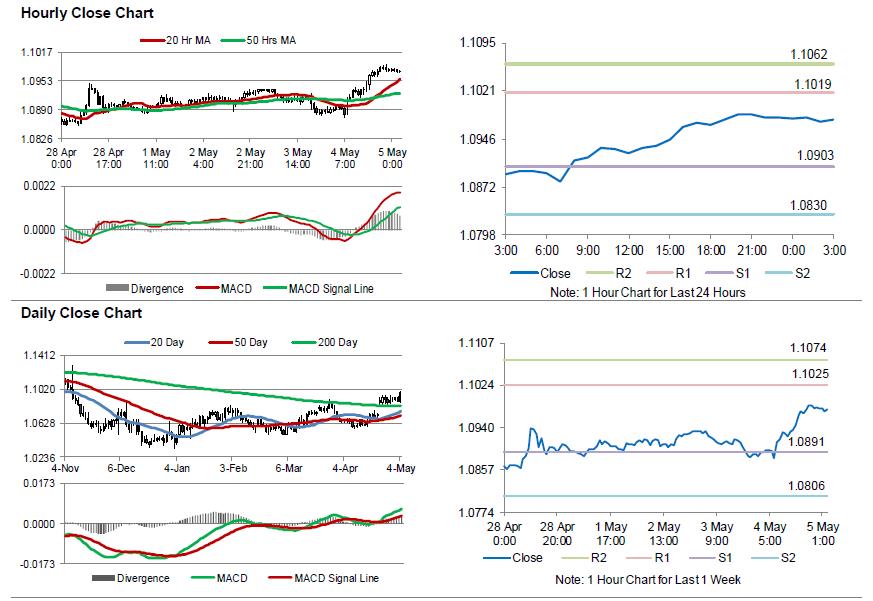

The pair is expected to find support at 1.0903, and a fall through could take it to the next support level of 1.0830. The pair is expected to find its first resistance at 1.1019, and a rise through could take it to the next resistance level of 1.1062.

Going ahead, market participants await the release of the European Commission’s economic growth forecasts report along with Germany’s construction PMI data for April, slated to release in a few hours. Additionally, in the US, crucial non-farm payrolls and unemployment report, both for April, slated to release later in the day, will garner significant amount of market attention.

The currency pair is trading/showing convergence with its 20 Hr and 50 Hr moving average.