For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.1921.

In economic news, the Euro-zone’s final Markit services PMI fell more than initially estimated to a level of 54.7 in August, while the preliminary figures had indicated a drop to a level of 54.9. The PMI had registered a level of 55.4 in the previous month. Moreover, the region’s seasonally adjusted retail sales retreated 0.3% on a monthly basis in July, meeting market expectations. In the previous month, retail sales had registered a revised rise of 0.6%.

Separately, growth in Germany’s services sector expanded more than initially estimated to a level of 53.5 in August, hitting a two-month high level. The PMI had recorded a reading of 53.1 in the previous month, while the flash print had recorded a rise to a level of 53.4.

The greenback lost ground against a basket of currencies, after a top Federal Reserve (Fed) official expressed caution about further interest rate hikes.

The US Fed Governor, Lael Brainard, urged for caution on raising interest rates further, until there is concrete evidence that inflation is on track to achieve the central bank’s target.

Losses in the US Dollar were extended, following downbeat economic data in the US.

Data revealed that the final durable goods orders dropped 6.8% MoM in July, in line with the preliminary print. Market participants had expected for a fall of 2.9%, after registering a gain of 6.4% in the prior month. Further, the nation’s factory orders tumbled by the most in nearly three years, after it dropped 3.3% on a monthly basis in July, meeting market consensus. Factory orders had recorded a revised rise of 3.2% in the prior month.

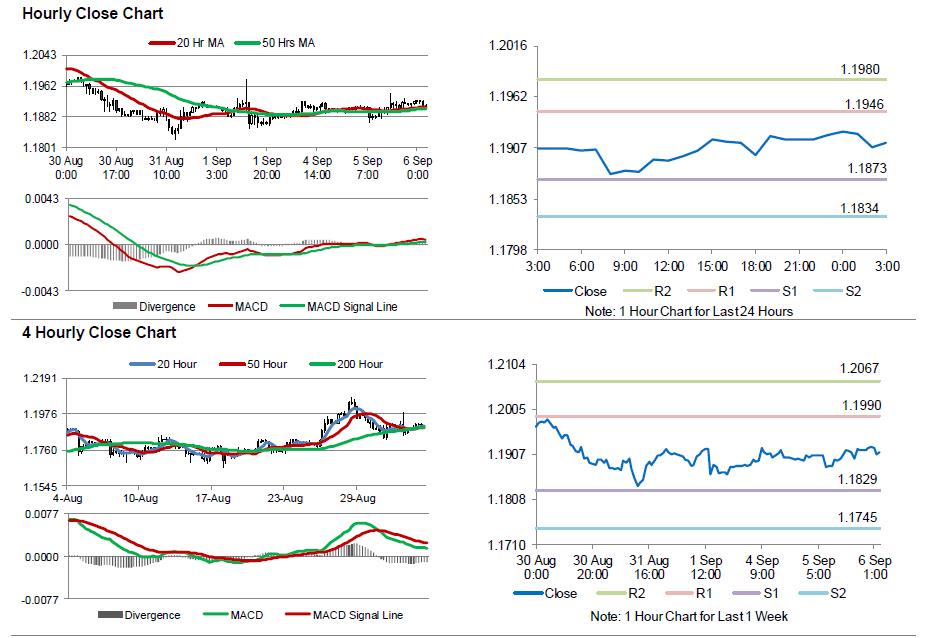

In the Asian session, at GMT0300, the pair is trading at 1.1912, with the EUR trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1873, and a fall through could take it to the next support level of 1.1834. The pair is expected to find its first resistance at 1.1946, and a rise through could take it to the next resistance level of 1.1980.

Going ahead, investors will focus on Germany’s Markit construction PMI for August and factory orders data for July, both slated to release in a few hours. Moreover, the US ISM non-manufacturing PMI for August and trade balance data for July, due to release later in the day, will attract a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.