For the 24 hours to 23:00 GMT, the EUR declined 0.55% against the USD and closed at 1.1150.

Macroeconomic data showed that the Euro-zone’s seasonally adjusted trade surplus narrowed more-than-expected to a level of €19.6 billion in April, compared to a revised surplus of €22.2 billion in the prior month, while market participants had expected the region to register a trade surplus of €22.3 billion.

The greenback gained ground against its key counterparts, following upbeat US jobless claims data that further supported the Federal Reserve’s (Fed) notion of a tightening labour market that could pave the way for another interest rate hike this year.

Data revealed that the number of Americans filing for fresh jobless claims dropped more-than-anticipated to a level of 237.0K in the week ended 10 June, compared market expectations of a fall to a level of 241.0K. In the previous week, initial jobless claims had registered a level of 245.0K. Moreover, the nation’s New York Empire State manufacturing index jumped more-than-expected to its highest level in nearly three years of 19.8 in June, compared to market consensus of an advance to a level of 4.0, thus indicating that business activity rebounded strongly in the New York state. The index had registered a level of -1.0 in the prior month. Meanwhile, the region’s Philadelphia Fed manufacturing index eased less-than-expected to a level of 27.6 in June, following a level of 38.8 in the prior month.

Another set of economic data showed that manufacturing production in the US unexpectedly fell 0.4% on a monthly basis in May, defying market expectations for a rise of 0.1%. In the previous month, manufacturing production had recorded a revised rise of 1.1%. Further, the nation’s industrial production remained flat on a monthly basis in May, whereas investors had envisaged for an advance of 0.2%. Industrial production had registered a revised rise of 1.1% in the previous month. Also, the nation’s NAHB housing market index surprisingly fell to a level of 67.0 in June, compared to market expectations of a rise to a level of 70.0. The index had recorded a revised level of 69.0 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1149, with the EUR trading slightly lower against the USD from yesterday’s close.

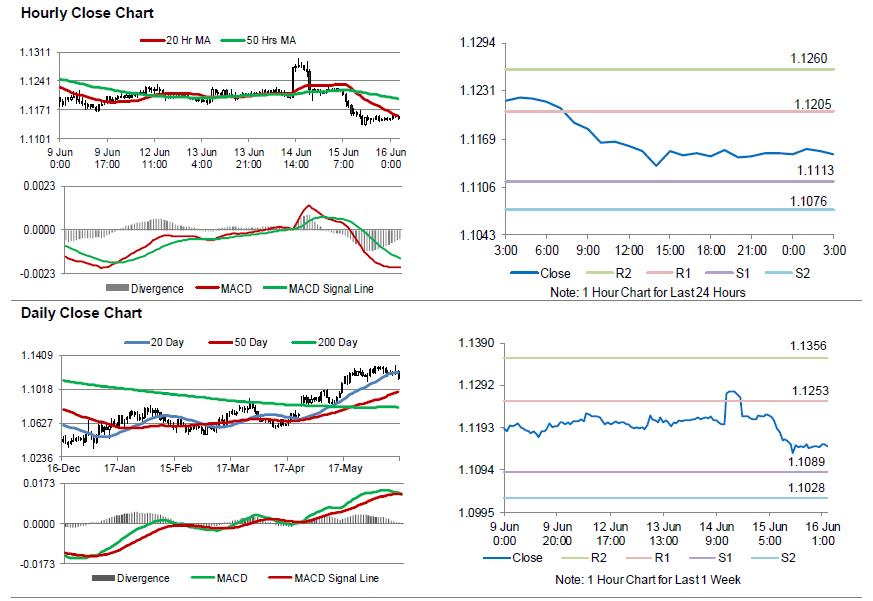

The pair is expected to find support at 1.1113, and a fall through could take it to the next support level of 1.1076. The pair is expected to find its first resistance at 1.1205, and a rise through could take it to the next resistance level of 1.1260.

Moving ahead, market participants will focus on the Euro-zone’s final consumer price index for May, slated to release in a few hours. Moreover, the US flash Michigan consumer sentiment index for June along with housing starts and building permits data for May, set to release later in the day, will garner significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.