For the 24 hours to 23:00 GMT, the EUR rose 0.55% against the USD and closed at 1.2338, as investors wagered that the European Central Bank would raise interest rates sooner than previously estimated.

On the macro front, the Euro-zone’s seasonally adjusted trade surplus narrowed to €19.9 billion in January, hitting a 3-month low level, dragged by a fall in exports. The region had registered a revised trade surplus of €23.2 billion in the prior month, while markets were expecting for a surplus of €22.5 billion. Additionally, the region’s seasonally adjusted construction output retreated 2.2% on a monthly basis in January, declining for the first time in 7 months. In the prior month, construction output had recorded a revised rise of 0.7%.

Separately, according to the Bundesbank monthly report, economic growth in Germany is likely to continue its robust momentum in the first quarter of the year, driven by solid performance in industrial sector.

In the Asian session, at GMT0400, the pair is trading at 1.2346, with the EUR trading 0.06% higher against the USD from yesterday’s close.

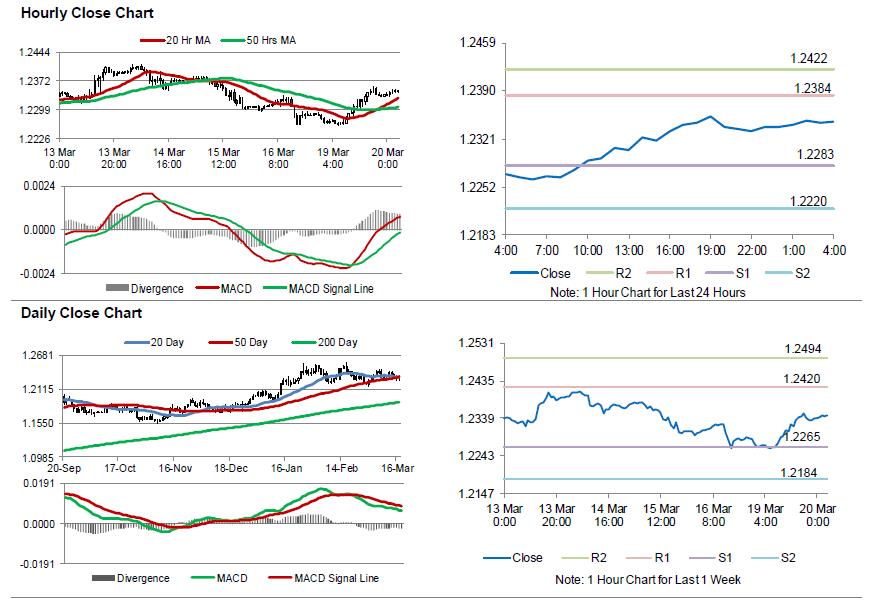

The pair is expected to find support at 1.2283, and a fall through could take it to the next support level of 1.2220. The pair is expected to find its first resistance at 1.2384, and a rise through could take it to the next resistance level of 1.2422.

Trading trend in the Euro today is expected to be determined by the release of the ZEW economic sentiment survey for March, scheduled to release across the Euro-zone in a few hours. Also, the Euro-zone’s flash consumer confidence index for March, slated to release later in the day, will be eyed by traders.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.