For the 24 hours to 23:00 GMT, the EUR rose 0.51% against the USD and closed at 1.0656, after the Euro-zone’s unemployment rate unexpectedly dropped to a more than seven-year low level of 9.8% in October, thus reflecting strong momentum in the region’s labour market. Markets expected unemployment rate to climb to 10.0%, compared to a revised level of 9.9% in the prior month. Additionally, growth in the region’s manufacturing sector was confirmed at 53.7, expanding at its fastest pace since January 2014 and following a level of 53.5 in the prior month.

Separately, Germany’s final Markit manufacturing PMI unexpectedly eased to a level of 54.3 in November, against market expectations for it to remain steady at a level of 54.4, recorded in the preliminary figures. The PMI had recorded a reading of 55.0 in the previous month.

Macroeconomic data indicated that the US ISM manufacturing activity index jumped to a five-month high level of 53.2 in November, amid a pickup in new orders and production, indicating that the nation’s economic growth remains on a strong footing. In the prior month, the ISM manufacturing activity index had recorded a reading of 51.9, while investors had envisaged for it to record a level of 52.4. Further, the final Markit manufacturing PMI was revised upwards to a level of 54.1 in November, matching its twenty-month high level and confounding market expectations of a rise to remain steady at a level of 53.9, recorded in the preliminary print. In the previous month, the Markit manufacturing PMI had recorded a level of 53.4. Meanwhile, the nation’s construction spending rose by 0.5% MoM in October, notching its seven-month high level and compared to a decline of 0.4% in the prior month. On the other hand, the number of Americans filing for fresh unemployment benefits rose to a five-month high level of 268.0K in the week ended 26 November 2016, higher than market expectations of an advance to a level of 253.0K and after recording a level of 251.0K in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.0679, with the EUR trading 0.22% higher against the USD from yesterday’s close.

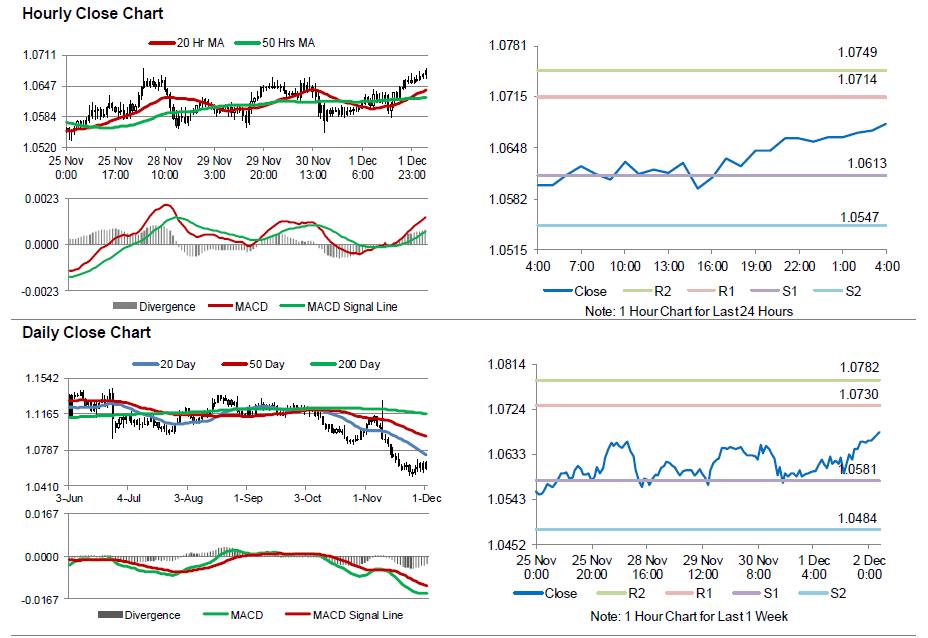

The pair is expected to find support at 1.0613, and a fall through could take it to the next support level of 1.0547. The pair is expected to find its first resistance at 1.0714, and a rise through could take it to the next resistance level of 1.0749.

Moving ahead, investors would look forward to the ECB’s interest rate decision, final Markit services PMI for November, along with the region’s Sentix investor confidence for December and final GDP for 3Q, all slated to release next week. Moreover, in the US, unemployment rate and change in non-farm payrolls data, both for November, slated to release later today, would pique a lot of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.