For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.1371 on Friday.

Data indicated that the Euro-zone’s unemployment rate remained steady at a 10-year low rate of 7.8% in January, compared to market consensus for a rise to 7.9%. Meanwhile, the region’s flash consumer price index (CPI) advanced 1.5% in February, meeting market expectations. The CPI had registered a rise of 1.4% in the prior month. On the other hand, the nation’s final manufacturing PMI contracted for the first time since June 2013 to level of 49.3 in February, compared to a reading of 50.5 in the prior month. The preliminary figures and market participants had indicated the PMI to drop to a level of 49.2.

Separately, in Germany, the seasonally adjusted unemployment rate remained unchanged at 5.0% in February, in line with market expectations. Moreover, retail sales rose 2.6% on a yearly basis in January, compared to a revised fall of 1.6% in the previous month. Market participants had envisaged theretail sales to advance 1.2%. Meanwhile, the nation’s final manufacturing PMI declined to a 74-month low level of 47.6 in February, at par with market expectations and confirming the preliminary print. In the prior month, the manufacturing PMI had recorded a reading of 49.7.

In the US, data showed that the US final Markit manufacturing PMI slid to an 18-month low level of 53.0 in February, amid decline in new order growth and compared to a level of 54.9 in the previous month. The preliminary figures and market participants had indicated the PMI to drop to a level of 53.7. Further, the nation’s ISM manufacturing activity index fell to a level of 54.2 in February, expanding at its weakest pace in two years and more than market expectations for a decline to a level of 55.7. In the previous month, the index had recorded a reading of 56.6. Additionally, personal spending fell 0.5% on a monthly basis in December, more than market consensus for a fall of 0.2%. Personal spending had registered a gain of 0.4% in the previous month. Furthermore, personal income unexpectedly fell 0.1% on a monthly basis in January, declining for the first time in 3-years, amid descending dividends and interest payments. In the prior month, the personal spending had recorded a gain of 1.0%.

On the flipside, the US final Reuters/Michigan consumer sentiment index climbed to a level of 93.8 in February, compared to a level of 91.2 in the previous month. Market participants and the preliminary figures had expected the index to rise to a level of 95.5.

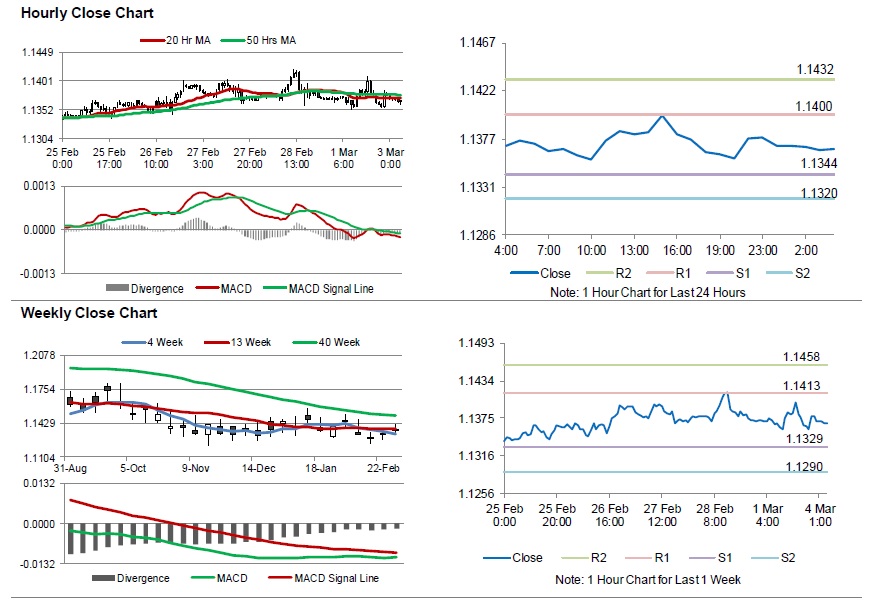

In the Asian session, at GMT0400, the pair is trading at 1.1367, with the EUR trading 0.08% higher against the USD from Friday’s close.

The pair is expected to find support at 1.1344, and a fall through could take it to the next support level of 1.1320. The pair is expected to find its first resistance at 1.1400, and a rise through could take it to the next resistance level of 1.1432.

Moving ahead, traders would await the Euro-zone’s Sentix investor confidence index for March and the producer price index for January, set to release in a few hours. Later in the day, the US construction spending data for December, will garner significant amount of investor’s attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.