For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.1769, after a surprise fall in the Euro-zone’s ZEW economic sentiment index.

Data indicated that the Euro-zone’s ZEW economic sentiment index surprisingly eased to a level of 26.7 in October, defying market consensus for an increase to a level of 34.2 and after recording a reading of 31.7 in the previous month. On the other hand, the region’s final consumer price index (CPI) climbed 1.5% on an annual basis in September, confirming the flash print and following a similar rise in the previous month.

Separately, mood among German investors slightly improved to a level of 17.6 in October, on the back of upbeat prospects for German exports as well as the broader economy. However, the index fell short of market expectations of a rise to a level of 20.0 and compared to a level of 17.0 in the previous month. On the contrary, the nation’s ZEW current situation index registered an unexpected drop to a level of 87.0 in October, confounding market consensus for an advance to a level of 88.5. In the prior month, the index had recorded a level of 87.9.

The greenback advanced against its major counterparts, following a string of robust economic releases in the US.

Data showed that the US industrial production rebounded 0.3% on a monthly basis in September, meeting market expectations. Industrial production had recorded a revised drop of 0.70% in the previous month. Also, the nation’s manufacturing production rebounded 0.1% MoM in September, following a revised fall of 0.2% in the prior month, while investors had envisaged for an increase of 0.2%. Moreover, the nation’s NAHB housing market index unexpectedly advanced to a five-month high level of 68.0 in October, compared to a level of 64.00 in the previous month. Markets were anticipating the index to record a steady reading.

Other economic data showed that the US import price index recorded a rise of 0.7% on a monthly basis in September, posting the biggest gain since June 2016 and compared to a gain of 0.6% in the prior month. Markets were anticipating the index to rise 0.6%. Further, the nation’s export price index increased 0.8% MoM in September, surpassing market expectations for an advance of 0.5% and following a revised rise of 0.7% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1773, with the EUR trading slightly higher against the USD from yesterday’s close.

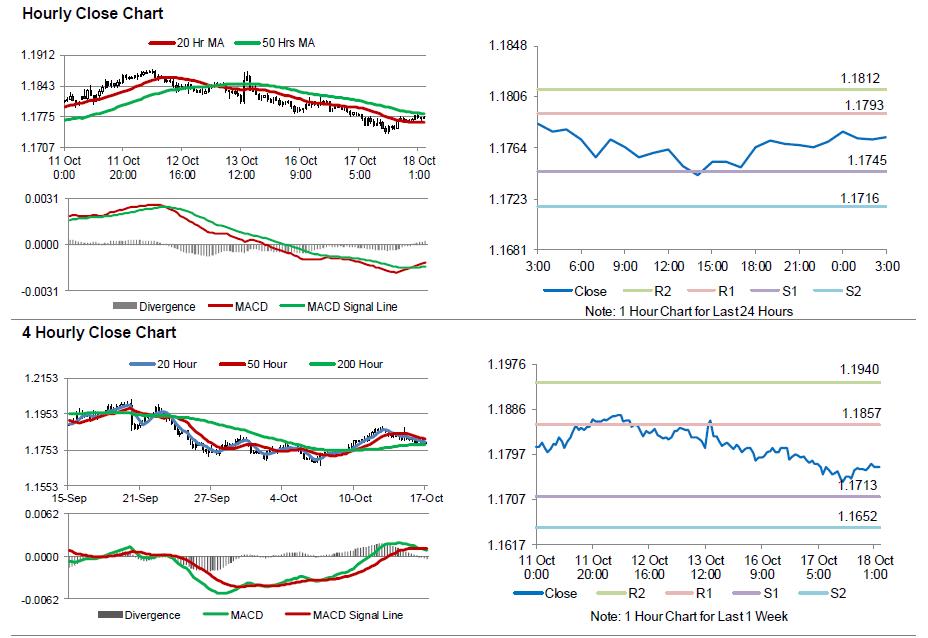

The pair is expected to find support at 1.1745, and a fall through could take it to the next support level of 1.1716. The pair is expected to find its first resistance at 1.1793, and a rise through could take it to the next resistance level of 1.1812.

Going ahead, investors will focus on a speech by the European Central Bank (ECB) President, Mario Draghi along with the Euro-zone’s construction output data for August, slated to release in a few hours. Moreover, in the US, housing starts and building permits data, both for September followed by the Federal Reserve’s Beige Book report, all scheduled to release later today, will be on investors’ radar.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.