For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.0593.

Yesterday, the European Commission (EC), in its quarterly economic forecast report, predicted that the Euro-zone’s economic growth is set to ease this year, but the slowdown would be less severe than expected earlier in November. Gross domestic product (GDP) of the single currency region is expected to grow 1.6% this year, up from 1.5% estimated in November and after registering a growth of 1.7% in 2016, while the 2018 forecast was revised up to 1.8% from 1.7%. However, the commission warned of “exceptional risks” looming on Euro-bloc’s recovery, stemming mainly from Britain’s vote to leave the EU, upcoming elections in Germany and France and uncertainty over the policies of US President, Donald Trump. Further, inflation forecast in the common currency region for this year was raised to 1.7% from 1.4%.

In the Asian session, at GMT0400, the pair is trading at 1.0602, with the EUR trading 0.08% higher against the USD from yesterday’s close.

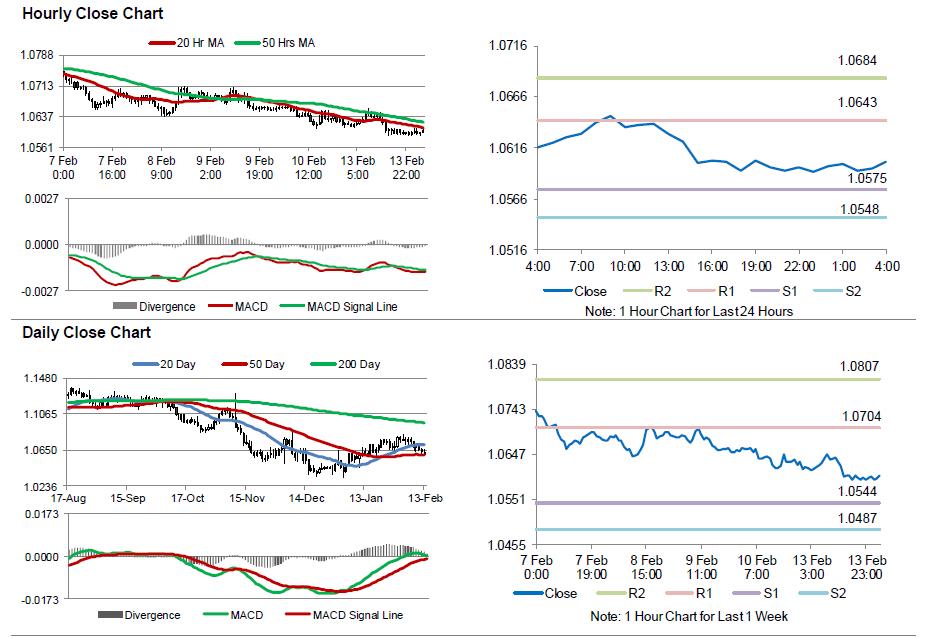

The pair is expected to find support at 1.0575, and a fall through could take it to the next support level of 1.0548. The pair is expected to find its first resistance at 1.0643, and a rise through could take it to the next resistance level of 1.0684.

Going ahead, market participants will look forward to the Eurozone’s flash 4Q GDP and ZEW economic sentiment index for February along with industrial production for December and Germany’s final consumer price inflation for January, scheduled to release in a few hours. Additionally, a speech by the Federal Reserve Chair, Janet Yellen, due later in the day, will be eyed by traders to get clues on the future path of monetary policy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.