For the 24 hours to 23:00 GMT, the EUR rose 0.33% against the USD and closed at 1.1173.

On the data front, Germany’s preliminary consumer price index (CPI) climbed less-than-expected by 1.5% on an annual basis in May, rising at its slowest pace in six months, thus supporting the European Central Bank’s (ECB) notion that underlying inflation in the common currency region still lacks sustainable uptrend. Meanwhile, markets expected the CPI to advance 1.6%, following a gain of 2.0% in the previous month.

Separately, the Euro-zone’s final consumer confidence index rose to a level of -3.3 in May, meeting flash estimates and compared to a revised reading of -3.6 in the previous month.

Macroeconomic data indicated that personal spending in the US grew at its quickest pace in four months, after it rose 0.4% on a monthly basis in April, meeting market expectations, thus underscoring expectations that the world’s largest economy is poised to rebound after a lacklustre growth in the first quarter. In the prior month, personal spending had registered a revised rise of 0.3%. Further, the nation’s personal income recorded a rise of 0.4% MoM in April, in line with market expectations. Personal income had registered a rise of 0.2% in the previous month.

In other economic news, the US CB consumer confidence index unexpectedly fell to a three-month low level of 117.9 in May, defying investor consensus for an advance to a level of 119.5. In the prior month, the index had recorded a revised reading of 119.4. Also, the nation’s Dallas Fed manufacturing business index surprisingly rose to a level of 17.2 in May, compared to a level of 16.8 in the previous month, while markets anticipated the index to ease to a level of 15.0.

Meanwhile, the Federal Reserve (Fed) Governor, Lael Brainard, stated that an interest rate hike is likely coming soon, but warned that if the recent slowdown persists, it could cause the Fed officials to reassess the path of monetary policy trajectory.

In the Asian session, at GMT0300, the pair is trading at 1.1175, with the EUR trading slightly higher against the USD from yesterday’s close.

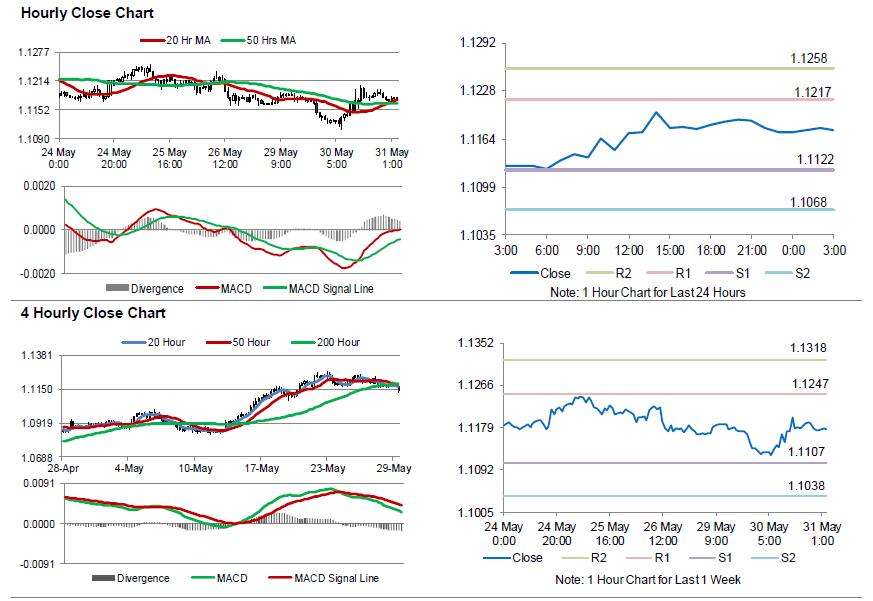

The pair is expected to find support at 1.1122, and a fall through could take it to the next support level of 1.1068. The pair is expected to find its first resistance at 1.1217, and a rise through could take it to the next resistance level of 1.1258.

Looking ahead, market participants will focus on the Euro-zone’s unemployment rate and inflation data, both for May along with Germany’s jobs report for May and retail sales data for April, slated to release in a few hours. Additionally, the US Fed Beige Book report and pending home sales data for April, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.