For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.0867, after Germany’s Ifo business climate index surprisingly jumped to a level of 112.9 in April, strengthening to its highest level in nearly 6 years, indicating that businesses are brushing off concerns about the threat of rising protectionism and uncertainties linked to Brexit as well as major European elections. The index registered a revised reading of 112.4 in the prior month, while markets expected for a steady reading.

Additionally, the nation’s Ifo current assessment index unexpectedly rose to a level of 121.1 in April, defying market expectations of a fall to a level of 119.2 and following a revised level of 119.5 in the previous month. On the other hand, the Ifo business expectations index unexpectedly eased to a level of 105.2 in April, contradicting market consensus for a rise to a level of 105.9, thus suggesting that firms remained cautious about the nation’s future economic outlook. The index recorded a level of 105.7 in the previous month.

Separately, the German Bundesbank indicated in its monthly report that high industrial orders, exceptionally optimistic manufacturing sentiment and a rebound in exports supported German economic growth during the first quarter. However, the bank warned that German GDP potential is likely to fall to 0.75% per year by 2025 from around 1.25% at present due to the nation’s aging labour force.

In economic news, the US Chicago Fed national activity index unexpectedly declined to a level of 0.08 in March, compared to a revised level of 0.27 in the previous month. Investors had envisaged for an advance to a level of 0.50. Further, the nation’s Dallas Fed manufacturing business index surprisingly dropped to a level of 16.8 in April, compared to market expectations of an advance to a level of 17.0. In the previous month, the had registered a reading of 16.9.

In the Asian session, at GMT0300, the pair is trading at 1.0861, with the EUR trading 0.06% lower against the USD from yesterday’s close.

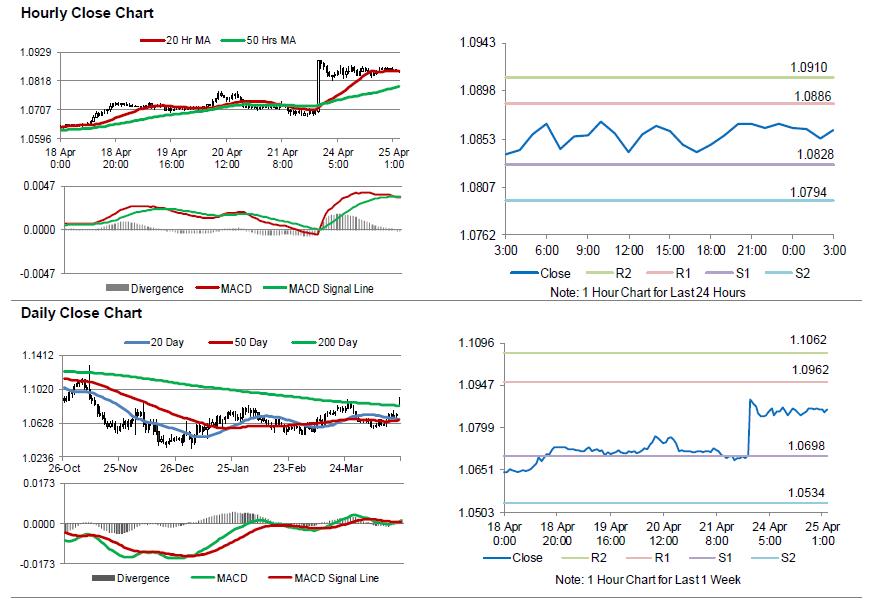

The pair is expected to find support at 1.0828, and a fall through could take it to the next support level of 1.0794. The pair is expected to find its first resistance at 1.0886, and a rise through could take it to the next resistance level of 1.0910.

With no major economic releases in the Euro-zone today, investors will look forward to the US consumer confidence index for April, new home sales for March and house price index for February, all slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.