For the 24 hours to 23:00 GMT, the EUR declined 0.65% against the USD and closed at 1.0677.

On the economic front, Germany’s GfK consumer confidence index rose to a level of 10.2 in February, escalating to a five-month high level, thus reaffirming that household spending will continue to propel growth in the first quarter of 2017. Meanwhile, markets expected for a rise to a level of 10.0, following a level of 9.9 in the previous month.

The US Dollar gained ground against its major peers, after data indicated that the US flash Markit services PMI rose to a level of 55.1 in January, expanding at its fastest pace in 14-months, thus pointing to a robust activity in services sector at the start of 2017. The PMI had registered a reading of 53.9 in the previous month, while market anticipated for an advance to a level of 54.4. Also, the nation’s flash wholesale inventories gained 1.0% on a monthly basis in December, higher than market expectations for an advance of 0.1% and following a similar rise in the prior month. Moreover, the CB leading indicator increased 0.5% in December, above market expectations of 0.2% gain. In the prior month, leading indicator had recorded a revised rise of 0.1%. Meanwhile, the nation’s goods trade deficit narrowed less-than-expected to a level of $65.0 billion in December, amid a pickup in exports and following a deficit of $65.3 billion in the previous month. On the other hand, the nation’s initial jobless claims climbed more-than-expected to a four-week high level of 259.0K in the week ended 21 January 2017, compared to a level of 234.0K in the prior week, while investors were anticipating initial jobless claims to advance to a level of 247.0K. Further, the nation’s new home sales plummeted to a ten-month low level, after it dropped 10.4%, to a level of 536.0K MoM in December, compared to market expectations for it to ease to a level of 588.0K and following a revised reading of 598.0K in the previous month.

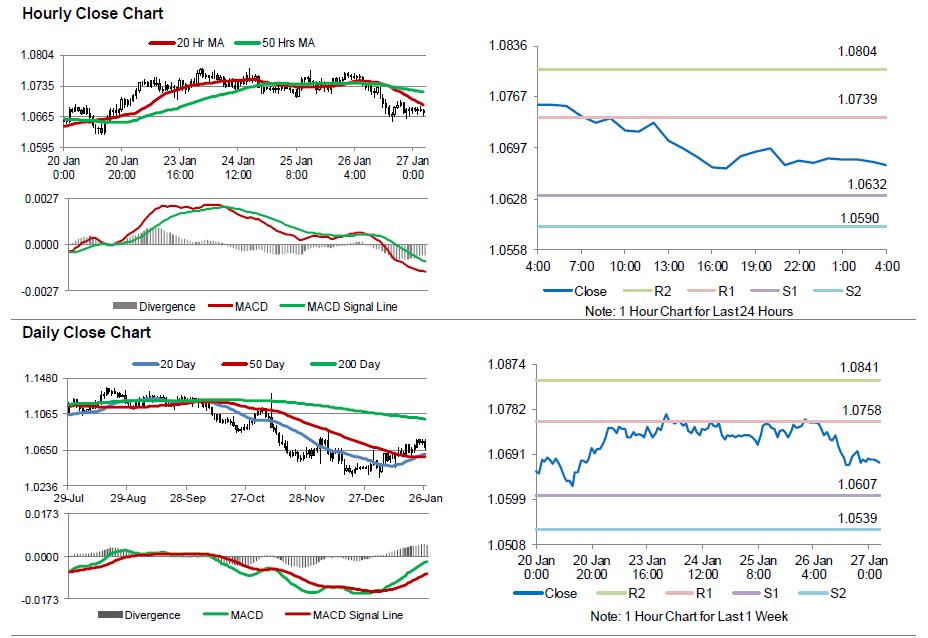

In the Asian session, at GMT0400, the pair is trading at 1.0674, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0632, and a fall through could take it to the next support level of 1.0590. The pair is expected to find its first resistance at 1.0739, and a rise through could take it to the next resistance level of 1.0804.

Going ahead, investors will look forward to Germany’s import price index for December, scheduled to release in a few hours. Moreover, the US flash annualised GDP for 4Q, durable goods orders for December and final Michigan consumer sentiment index for January, all slated to release later today, will also garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.