For the 24 hours to 23:00 GMT, the EUR rose 0.2% against the USD and closed at 1.0575, after Germany’s seasonally adjusted final gross domestic product (GDP) grew 0.4% QoQ in 4Q 2016, driven by robust government spending, confirming the preliminary print and growing faster than the 0.1% expansion seen in the previous quarter. On the contrary, the nation’s GfK consumer confidence index dropped more-than-expected to a level of 10.0 in March, as rising inflation and change in the US administration dampened economic expectations. In the prior month, the index had registered a level of 10.2, while markets expected the index to fall to a level of 10.1.

In the US, data showed that initial jobless claims advanced to a level of 244.0K in the week ended 18 February 2017, compared to investor expectations of a rise to a level of 240.0K. In the previous week, initial jobless claims had recorded a revised level of 238.0K. Moreover, the nation’s house price index advanced less-than-anticipated by 0.4% on a monthly basis in December, compared to market expectations for a rise of 0.5% and following a revised rise of 0.7% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0579, with the EUR trading a tad higher against the USD from yesterday’s close.

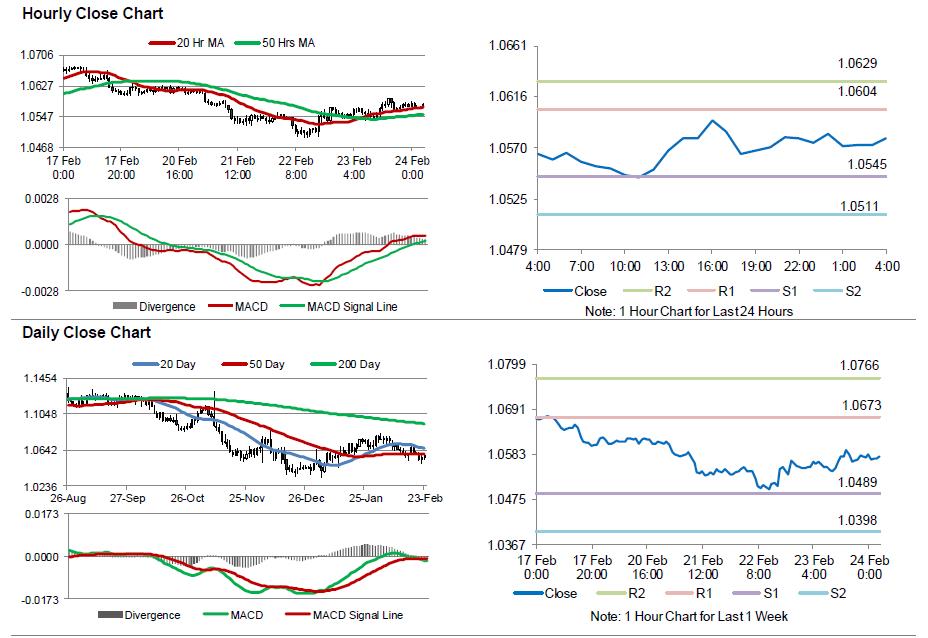

The pair is expected to find support at 1.0545, and a fall through could take it to the next support level of 1.0511. The pair is expected to find its first resistance at 1.0604, and a rise through could take it to the next resistance level of 1.0629.

Going ahead, investors will look forward to the consumer price index, final Markit manufacturing and services PMI and retail sales data across the Euro-zone, scheduled to release next week.

Also, Germany’s jobs report will be eyed by investors. Meanwhile, today in the US, final Michigan consumer confidence index and new home sales data, will be on investor’s radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.