For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.1733 on Friday, after data showed that Germany’s seasonally adjusted factory orders rebounded 3.6% on a monthly basis in August, beating market expectations for a rise of 0.7% and rising by the most in eight months, thus pointing to a solid growth in the nation’s manufacturing sector. In the previous month, factory orders had dropped by a revised 0.4%.

The greenback lost ground against a basket of major currencies on Friday, on the back of worse-than-expected US non-farm payrolls report.

The US non-farm payrolls unexpectedly fell by 33.0K in September, dropping for the first time in seven-years, as the pace of job creation was held down by the severe disruptions caused by a pair of hurricanes. In the prior month, non-farm payrolls had registered a revised gain of 169.0K, while markets had anticipated for a rise of 80.0K.

On the contrary, the nation’s average hourly earnings of all employees rose more-than-anticipated by 0.5% on a monthly basis in September, suggesting that a slack in the nation’s wage growth may be disappearing and boosting the odds of a Federal Reserve interest rate hike by the year-end. Average hourly earnings of all employees posted a revised gain of 0.2% in the prior month, while markets were anticipating for a rise of 0.3%. Moreover, the nation’s unemployment rate unexpectedly declined to 4.2% in September, dipping to a sixteen-year low level, while investors had envisaged the nation’s unemployment rate to remain unchanged at 4.4%.

In other economic news, the US final wholesale inventories rose less than initially estimated by 0.9% on a monthly basis in August, while the preliminary figures had recorded an advance of 1.0% and following a rise of 0.6% in the previous month. Also, the nation’s consumer credit recorded a rise of $13.07 billion in August, falling short of market consensus for an increase of $15.54 billion. Consumer credit had registered a revised rise of $17.72 billion in the previous month.

Losses in the US Dollar were extended after a report that North Korea is preparing to test a long-range missile that could reach the US west coast.

In the Asian session, at GMT0300, the pair is trading at 1.1741, with the EUR trading 0.07% higher against the USD from Friday’s close.

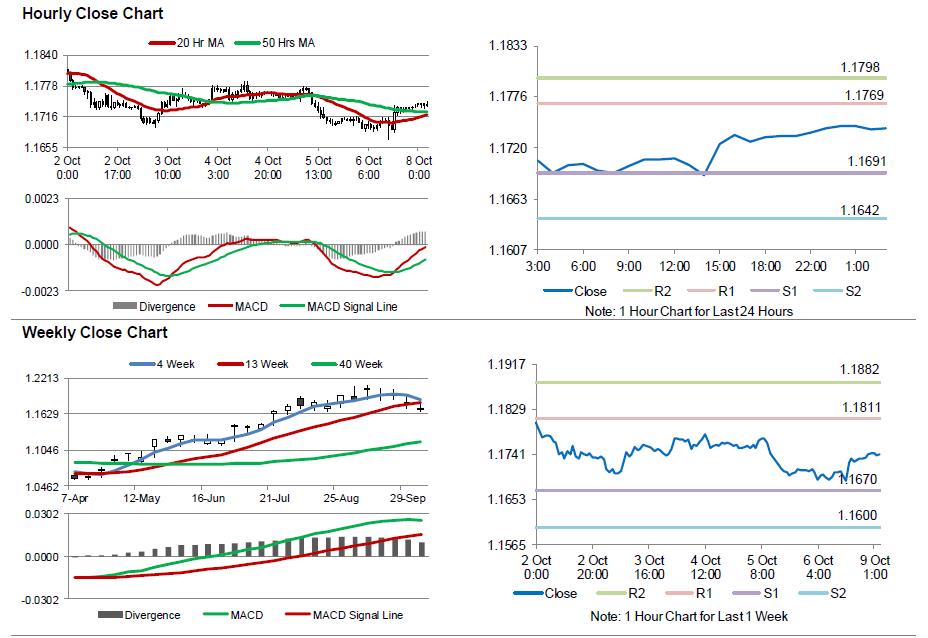

The pair is expected to find support at 1.1691, and a fall through could take it to the next support level of 1.1642. The pair is expected to find its first resistance at 1.1769, and a rise through could take it to the next resistance level of 1.1798.

Going ahead, investors will focus on the Euro-zone’s Sentix investor confidence index for October and Germany’s industrial production data for August, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.