For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.1764, pressured by a weaker-than-expected reading on investor confidence across the Euro-zone.

Data indicated that the Euro-zone’s ZEW economic sentiment index dropped more-than-anticipated to a level of 29.3 in August, hitting its lowest since April 2017, thus suggesting that a surge in the Euro may be denting investor confidence. The index had recorded a level of 35.6 in the prior month.

Separately, mood among German investor deteriorated to a ten-month low level of 10.0 in August, amid concerns over the nation’s growth outlook and emissions scandal engulfing the German automobile industry. The index had recorded a reading of 17.5 in the previous month, while markets had expected for a fall to a level of 15.0. On the other hand, the nation’s ZEW current situation index unexpectedly rose to a level of 86.7 in August, defying market expectations for a fall to a level of 85.2. In the previous month, the index had registered a reading of 86.4.

In the US, data indicated that the housing price index climbed 0.1% on a monthly basis in June, falling short of market consensus for a rise of 0.5% and posting the slowest pace of growth since November 2013. In the prior month, the index had recorded a rise of 0.4%. Meanwhile, the nation’s Richmond Fed manufacturing index remained steady at 14.0 in August, while investors had envisaged for a drop to a level of 10.0.

In the Asian session, at GMT0300, the pair is trading at 1.1763, with the EUR trading a tad lower against the USD from yesterday’s close.

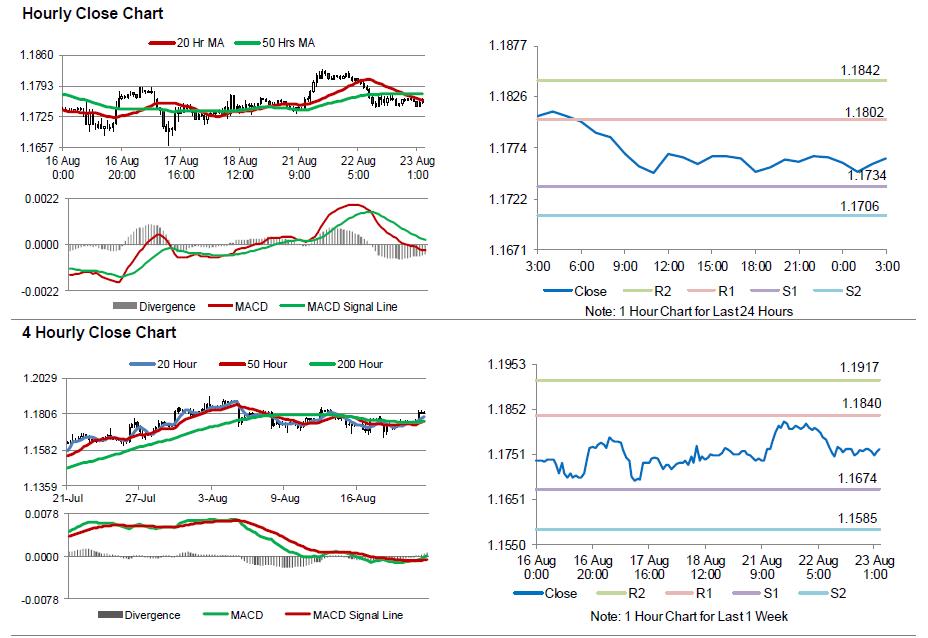

The pair is expected to find support at 1.1734, and a fall through could take it to the next support level of 1.1706. The pair is expected to find its first resistance at 1.1802, and a rise through could take it to the next resistance level of 1.1842.

Moving ahead, investors will focus on the flash Markit manufacturing and services PMIs data for August across the Eurozone, slated to release in a few hours. Also, the Euro-zone’s flash consumer confidence data for August, due to release later in the day, will be on investors’ radar. Moreover, the US Markit manufacturing and services PMIs for August and new home sales data for July, scheduled to release later today, will garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.