For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.2128 on Friday.

On the macro front, the Euro-zone’s final consumer confidence index rose to a level of 0.4 in April, confirming the preliminary print and compared to a reading of 0.1 in the previous month. Meanwhile, the region’s economic sentiment indicator remained unchanged at a level of 112.7 in April, defying market expectations for a drop to a level of 112.0.

Separately, Germany’s seasonally adjusted unemployment rate remained steady at 5.3% in April, meeting market consensus and highlighting strength in the nation’s labour market.

The US Dollar pared some of its losses against a basket of major currencies on Friday, following better-than-expected first-quarter gross domestic product (GDP) print in the US.

Data indicated that the flash annualised GDP in the US climbed more-than-anticipated by 2.3% on a quarterly basis in the first three months of 2018, compared to market expectations for an advance of 2.0%. The nation’s GDP had recorded a rise of 2.9% in the previous quarter.

In other economic news, the US final Reuters/Michigan consumer sentiment index dropped less than initially estimated to a level of 98.8 in April, compared to a reading of 101.4 in the prior month, while the preliminary figures had indicated a fall to a level of 97.8.

In the Asian session, at GMT0300, the pair is trading at 1.213, with the EUR trading slightly higher against the USD from Friday’s close.

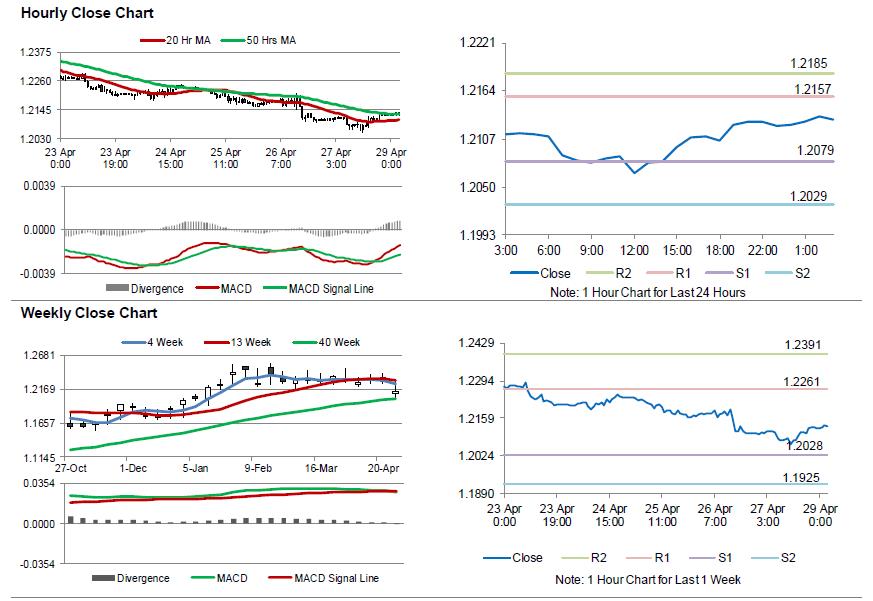

The pair is expected to find support at 1.2079, and a fall through could take it to the next support level of 1.2029. The pair is expected to find its first resistance at 1.2157, and a rise through could take it to the next resistance level of 1.2185.

Moving ahead, traders would focus on the release of Germany’s flash inflation numbers for April and retail sales data for March, due in a few hours. Also, the US pending home sales, personal income as well as spending data, all for March, scheduled to release later today, will keep investors on their toes.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.