For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1821 on Friday.

In economic news, Germany’s final consumer price index (CPI) rose 1.8% YoY in September, confirming the preliminary print and following a similar rise in the prior month.

The greenback declined against its major counterparts on Friday, on the heels of weaker-than-expected US inflation report.

Data showed that consumer price inflation in the US climbed less-than-anticipated by 0.5% on a monthly basis in September, while market participants had expected for a rise of 0.6%. Nevertheless, it was the biggest increase in eight months, amid a rise in gasoline prices following Hurricane Harvey. The CPI had recorded a rise of 0.4% in the previous month. Moreover, the nation’s advance retail sales rebounded 1.6% in September, rising by the most in nearly three years, driven by strong auto and auto parts sales. However, investors had envisaged advance retail sales to rise by 1.7%, after registering a revised drop of 0.1% in the prior month.

Other economic data indicated that the US flash Reuters/Michigan consumer sentiment index unexpectedly climbed to a thirteen-year high level of 101.1 in October, defying market expectations for a drop to a level of 95.0, offering signs that Americans turned upbeat about the nation’s growth prospects. In the prior month, the index had registered a level of 95.1.

Over the weekend, the Federal Reserve (Fed) Chair, Janet Yellen, stated that the central bank expects to continue raising interest rates gradually as ongoing strength of the US economy and tightening labour market will eventually boost inflation. Further, Yellen acknowledged that the persistence of undesirably low inflation this year has been a surprise and that the central bank will be paying close attention to the inflation data in the months ahead. Yellen also reiterated that the impact of recent hurricanes on the economy would be temporary.

In the Asian session, at GMT0300, the pair is trading at 1.1807, with the EUR trading 0.12% lower against the USD from Friday’s close.

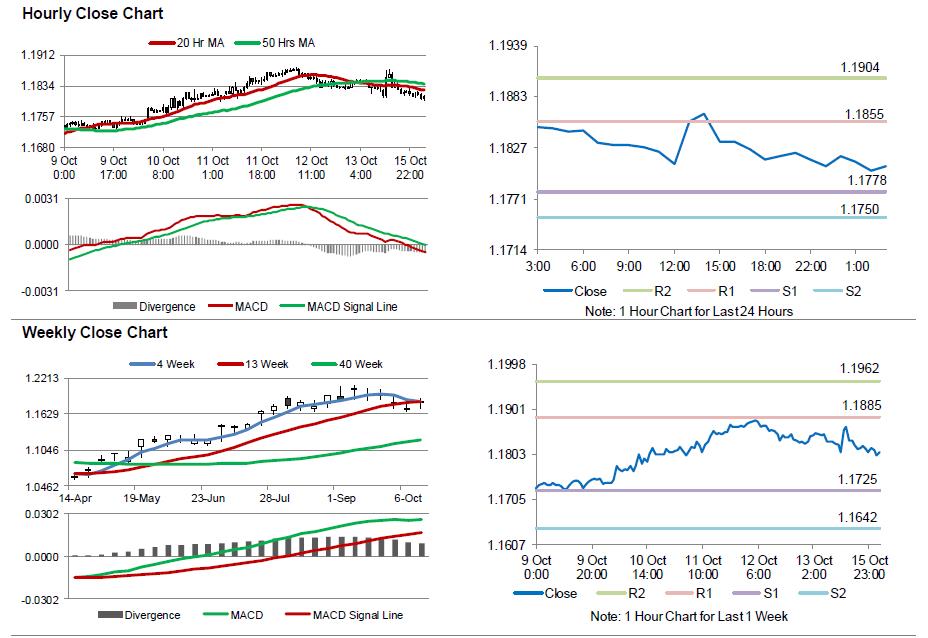

The pair is expected to find support at 1.1778, and a fall through could take it to the next support level of 1.1750. The pair is expected to find its first resistance at 1.1855, and a rise through could take it to the next resistance level of 1.1904.

Going ahead, investors will focus on the Euro-zone’s trade balance for August, slated to release in a few hours. Moreover, the US New York Empire State manufacturing index for October, due to release later today, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.