For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.1823 on Friday.

In economic news, data revealed that Germany’s final consumer price index (CPI) climbed 1.7% on an annual basis in July, confirming the preliminary print. The CPI had risen 1.6% in the previous month.

The greenback lost ground against a basket of currencies, after weaker-than-expected US inflation data dashed hopes of another Federal Reserve interest rate hike before the year-end.

Data showed that consumer price inflation in the US rose less-than-expected by 0.1% on a monthly basis in July, offering fresh signs that price pressures in the world’s largest economy remain muted. In the previous month, the CPI had registered a flat reading, while markets participants had expected for an advance of 0.2%. Meanwhile, on an annual basis, the CPI increased less-than-anticipated by 1.7% in July. In the prior month, the CPI had risen 1.6%.

Meanwhile, the US President, Donald Trump issued a new warning to North Korea, stating that the US military was “locked and loaded” on the nation.

Separately, Russia’s Foreign Minister, Sergei Lavrov, stated that there was a Russian-Chinese plan to defuse tensions between the US and North Korea.

In the Asian session, at GMT0300, the pair is trading at 1.1829, with the EUR trading a tad higher against the USD from Friday’s close.

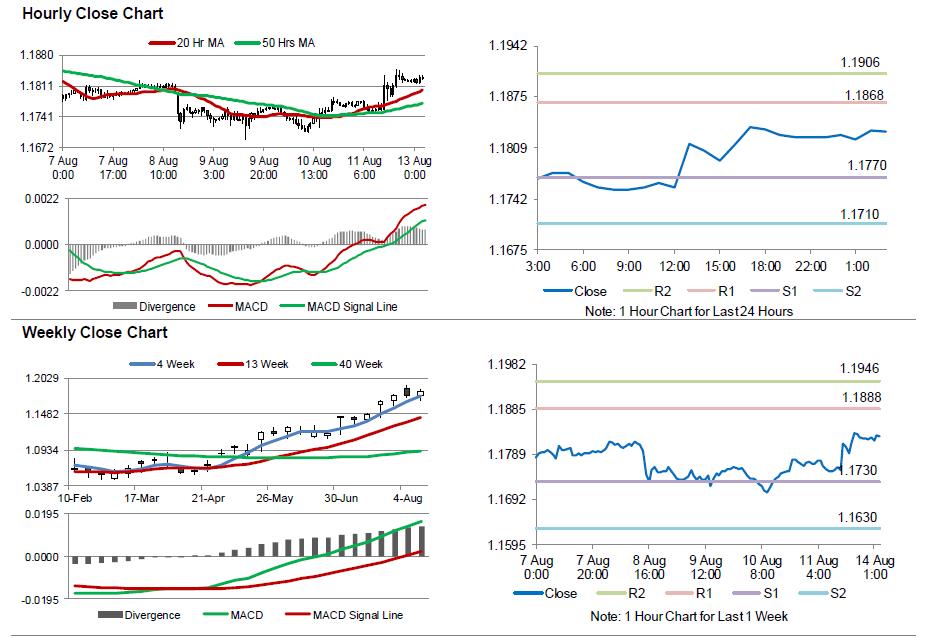

The pair is expected to find support at 1.1770, and a fall through could take it to the next support level of 1.1710. The pair is expected to find its first resistance at 1.1868, and a rise through could take it to the next resistance level of 1.1906.

Moving ahead, investors will keep a close watch on the Euro-zone’s industrial production data for June, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.