For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.1852, after data showed that inflation in the Euro-zone’s largest economy picked up for first time in three months in November.

The flash consumer price index (CPI) in Germany rose more-than-expected by 1.8% on an annual basis in November, offering signs that robust growth in the nation’s economy may be translating into higher prices. The CPI had registered a gain of 1.6% in the previous month, while markets were expecting for an increase of 1.7%.

Additionally, the Euro-zone’s final consumer confidence index climbed to a 16-year high level of 0.1 in November, confirming the preliminary print. In the preceding month, the index had recorded a revised reading of -1.1. Moreover, the region’s economic confidence index jumped to a level of 114.6 in November, hitting its highest level since October 2000 and meeting market expectations. In the prior month, the index had registered a revised reading of 114.1.

The greenback gained ground against a basket of major currencies, propelled by upbeat remarks on the US economy by the Federal Reserve (Fed) Chair, Janet Yellen.

The Fed Chair stated that economic expansion in the US has gained strength this year and this would encourage the central bank to continue gradual interest rate hikes in order to sustain a healthy labour market and stabilise inflation at the its target. However, Yellen expressed significant concerns over the nation’s surging public debt and income inequality.

Separately, the Fed Beige Book report indicated that economic growth across the US advanced at a modest to moderate pace in October through mid-November. Further, it revealed that inflationary pressures have strengthened and the labour market has continued to tighten.

On the data front, the second estimate of annualised gross domestic product (GDP) showed that the US economy climbed more than initially estimated by 3.3% QoQ in the third quarter of 2017, notching its fastest pace in three years, buoyed by robust business spending. The annualised GDP had recorded a rise of 3.1% in the prior quarter, while the preliminary figures had indicated a rise of 3.0%. Also, the nation’s pending home sales rebounded 3.5% on a monthly basis in October, beating markets consensus for a rise of 1.0% and compared to a revised fall of 0.4% in the prior month.

On the other hand, the nation’s mortgage applications declined 3.1% in the week ended 24 November. Mortgage applications had climbed 0.1% in the previous week.

Meanwhile, the Senate Budget Committee, voted 52-48 to begin formal debate on a key Republican tax bill.

In the Asian session, at GMT0400, the pair is trading at 1.1866, with the EUR trading 0.12% higher against the USD from yesterday’s close.

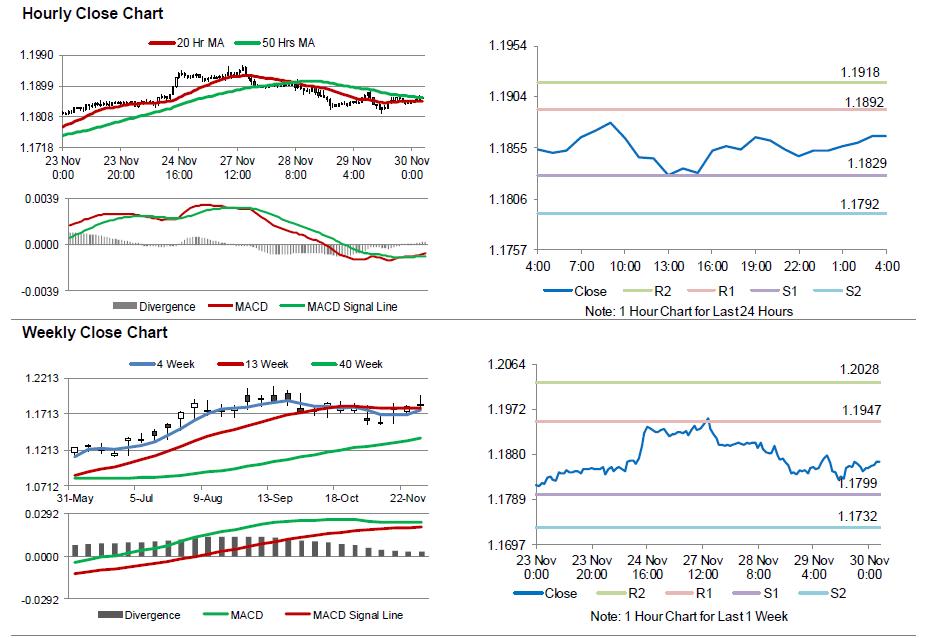

The pair is expected to find support at 1.1829, and a fall through could take it to the next support level of 1.1792. The pair is expected to find its first resistance at 1.1892, and a rise through could take it to the next resistance level of 1.1918.

Trading trend in the Euro today is expected to be determined by the release of the Euro-zone’s CPI for November and unemployment rate data for October, scheduled to release in a few hours. Moreover, Germany’s unemployment rate data for November and retail sales data for October, will also garner significant amount of investor attention. Additionally, the US initial jobless claims, followed by personal income and spending data for October, will be on investors’ radar.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.