For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.1259.

In economic news, Germany’s final consumer price index (CPI) advanced 1.3% on a yearly basis in March, in line with market expectations and confirming the preliminary print. In the prior month, the CPI had recorded a rise of 1.5%.

The US dollar gained ground against a basket of currencies, following upbeat US economic data.

In the US, data showed that the US producer price index (PPI) rose to a 5-month high level of 2.2% on an annual basis in March, surpassing market anticipations for a climb of 1.9%. In the prior month, the PPI had registered a rise of 1.9%. Moreover, the nation’s seasonally adjusted initial jobless claims unexpectedly declined to a level of 196.0K in the week ended 06 April 2019, declining to its lowest level since 1969 and defying market consensus for a rise to a level of 210.0K. Initial jobless claims had recorded a revised reading of 204.0K in the preceding week.

In the Asian session, at GMT0300, the pair is trading at 1.1288, with the EUR trading 0.26% higher against the USD from yesterday’s close.

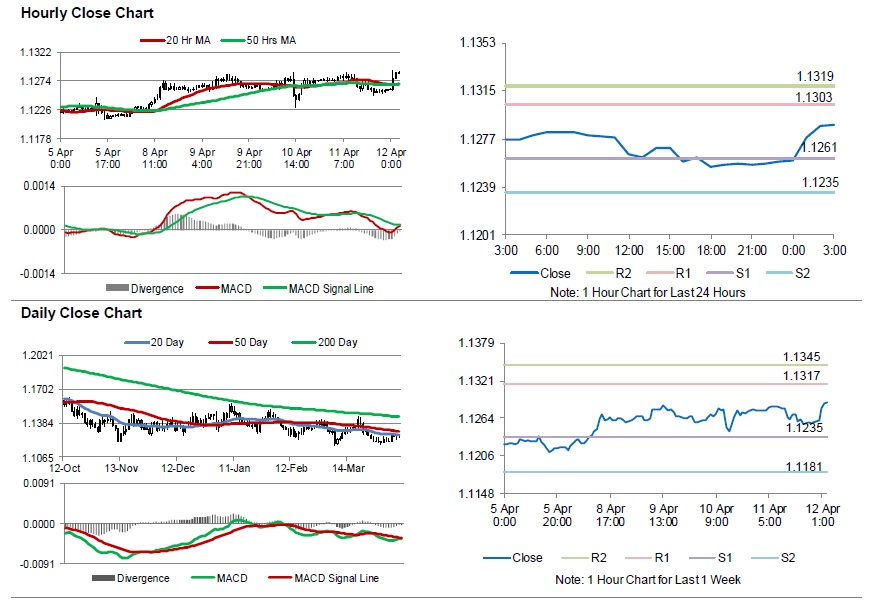

The pair is expected to find support at 1.1261, and a fall through could take it to the next support level of 1.1235. The pair is expected to find its first resistance at 1.1303, and a rise through could take it to the next resistance level of 1.1319.

Moving ahead, traders would keep an eye on the Euro-zone’s industrial production for February, slated to release in a few hours. Later in the day, the US Michigan consumer sentiment index for April, will be on investors radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.