For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1092.

On the macro front, Germany’s seasonally adjusted final gross domestic product (GDP) fell 0.1% on a quarterly basis in 2Q 2019, at par with market expectations and confirming the preliminary figures. In the prior quarter, GDP had recorded a rise of 0.4%.

In the US data showed that the Richmond Fed manufacturing index climbed to a level of 1.0 in August, more than market consensus for a rise to a level of -4.0. In the previous month, the index had recorded a reading of -12.0. Moreover, the US housing price index advanced 0.2% on a monthly basis in June, meeting market expectations. The index had registered a revised similar rise in the previous month.

On the other hand, the nation’s CB consumer confidence index fell to a level of 135.1 in August, less than market anticipations for a fall to a level of 129.0. In the previous month, the index had registered a revised reading of 135.8.

In the Asian session, at GMT0300, the pair is trading at 1.1088, with the EUR trading marginally lower against the USD from yesterday’s close.

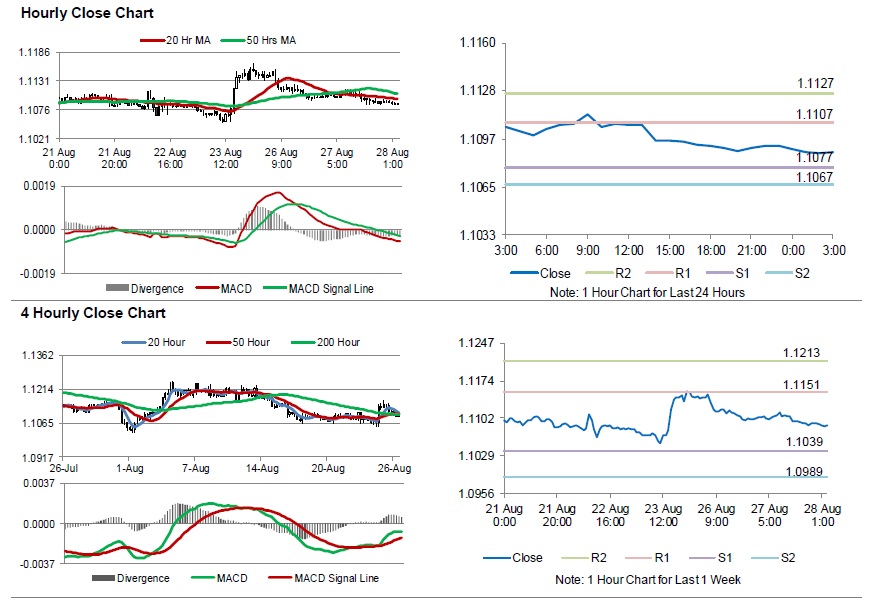

The pair is expected to find support at 1.1077, and a fall through could take it to the next support level of 1.1067. The pair is expected to find its first resistance at 1.1107, and a rise through could take it to the next resistance level of 1.1127.

Looking forward, traders would await the Euro-zone’s M3 money supply for July along with Germany’s GfK consumer confidence index for September, set to release in a few hours. Later in the day, the US MBA mortgage applications will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.