For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1036.

In economic news, Germany’s seasonally adjusted factory orders eased 2.7% on a monthly basis in July, compared to a revised rise of 2.7% in the prior month. Market participants had expected factory orders to record a drop of 1.4%. Moreover, the nation’s construction PMI fell to a level of 46.3 in August, compared to a level of 49.5 in the preceding month.

In the US, data showed that the final Markit services PMI declined to a record low level of 50.7 in August, more than market anticipations and preliminary figures for a fall to a level of 50.9. In the previous month, the PMI had recorded a reading of 53.0. Further, the nation’s seasonally adjusted initial jobless claims unexpectedly advanced to a level of 217.0K on a weekly basis in the week ended 31 August 2019, defying market anticipations for a fall to a level of 215.0K. In the preceding week, initial jobless claims recorded a revised level of 216.0K. Meanwhile, the final durable goods orders increased 2.0% on a monthly basis in July, undershooting market consensus for a gain of 2.1%. In the prior month, durable goods orders had recorded a revised rise of 1.8%.

On the other hand, the US ADP private sector employment advanced by 195.0K in August, surpassing market consensus for a rise of 148.0K. In the previous month, the private sector employment rate had recorded a revised increase of 142.0K. Moreover, the nation’s factory orders rose 1.4% on a monthly basis in July, rising for the second straight month and compared to a revised rise of 0.5% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1034, with the EUR trading slightly lower against the USD from yesterday’s close.

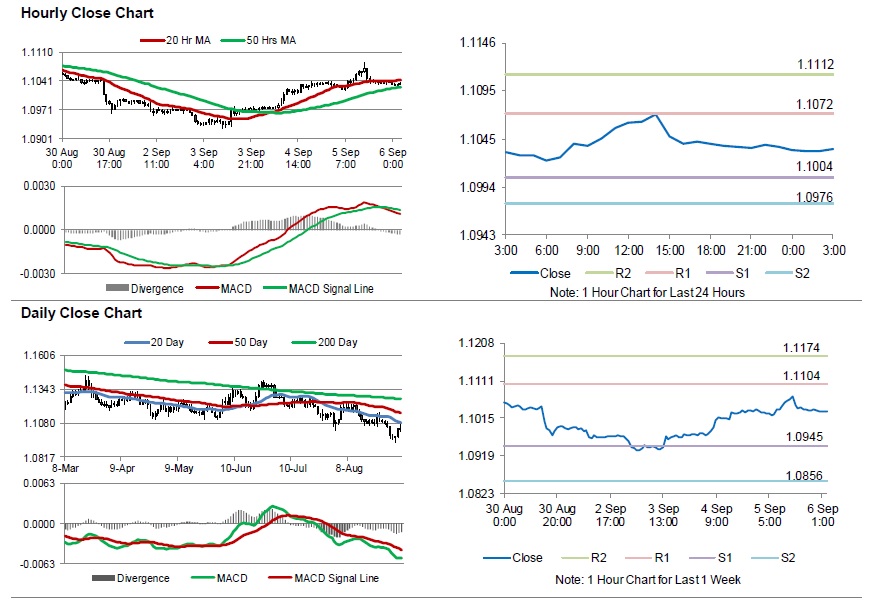

The pair is expected to find support at 1.1004, and a fall through could take it to the next support level of 1.0976. The pair is expected to find its first resistance at 1.1072, and a rise through could take it to the next resistance level of 1.1112.

Looking ahead, traders would await the Euro-zone’s gross domestic product for 2Q 2019 along with Germany’s industrial production for July, set to release in a few hours. Later in the day, the US non-farm payrolls, unemployment rate and average hourly earnings, all for August, will pique significant amount of investors’ attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.